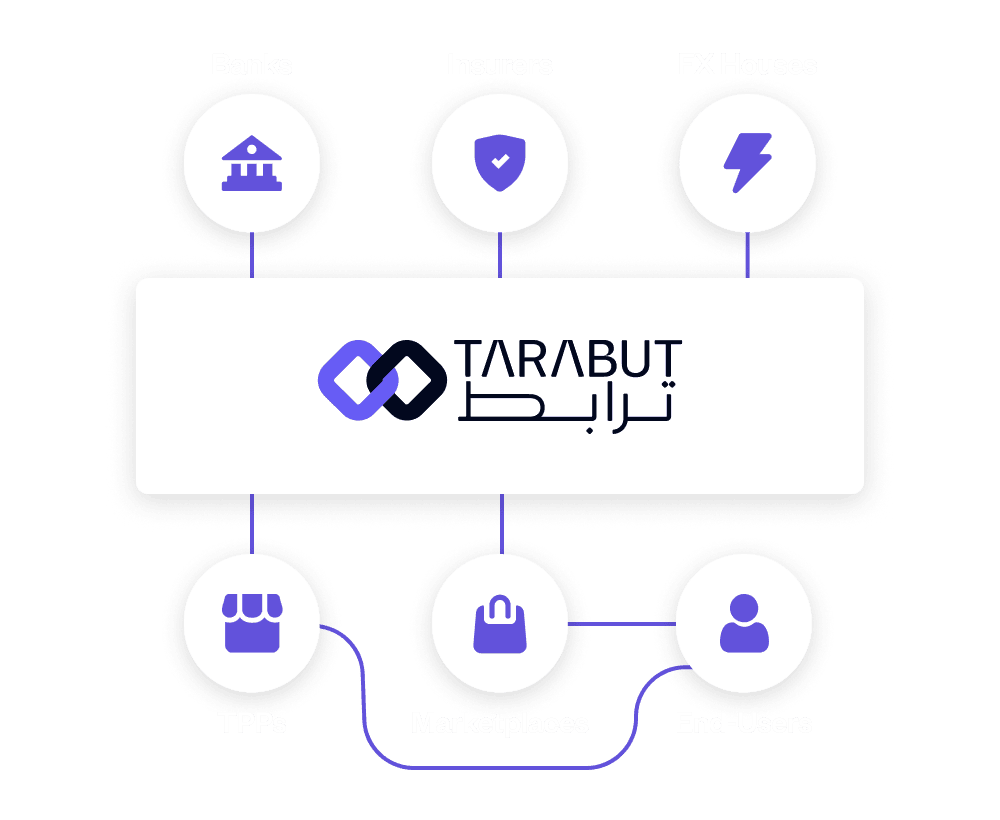

Why partner with Tarabut?

How it works

Our platform brings together regulatory expertise, proprietary technology, and pre-integrated partner components to deliver a ready-to-go compliance foundation.

Core capabilities

We combine implementation speed with rigorous compliance coverage, so you don’t just meet the standard, you set it.

Who it's for

Banks

Comply with open finance frameworks, fast. Launch and manage APIs with full transparency, auditability, and the ability to scale toward monetisation.

TPPs

Access high-quality, standardised APIs. Build and scale products faster with reliable, regulated data connections and a trusted, expert partner.

Insurers

Prepare for open finance requirements. Extend your reach with compliant access to data and embedded financial experiences.

Retail & SMEs

Use cases

Use cases

Discover how compliance unlocks real-world use cases in lending, payments, onboarding, credit scoring, and embedded finance - powered by premium APIs that are built for scale and speed.

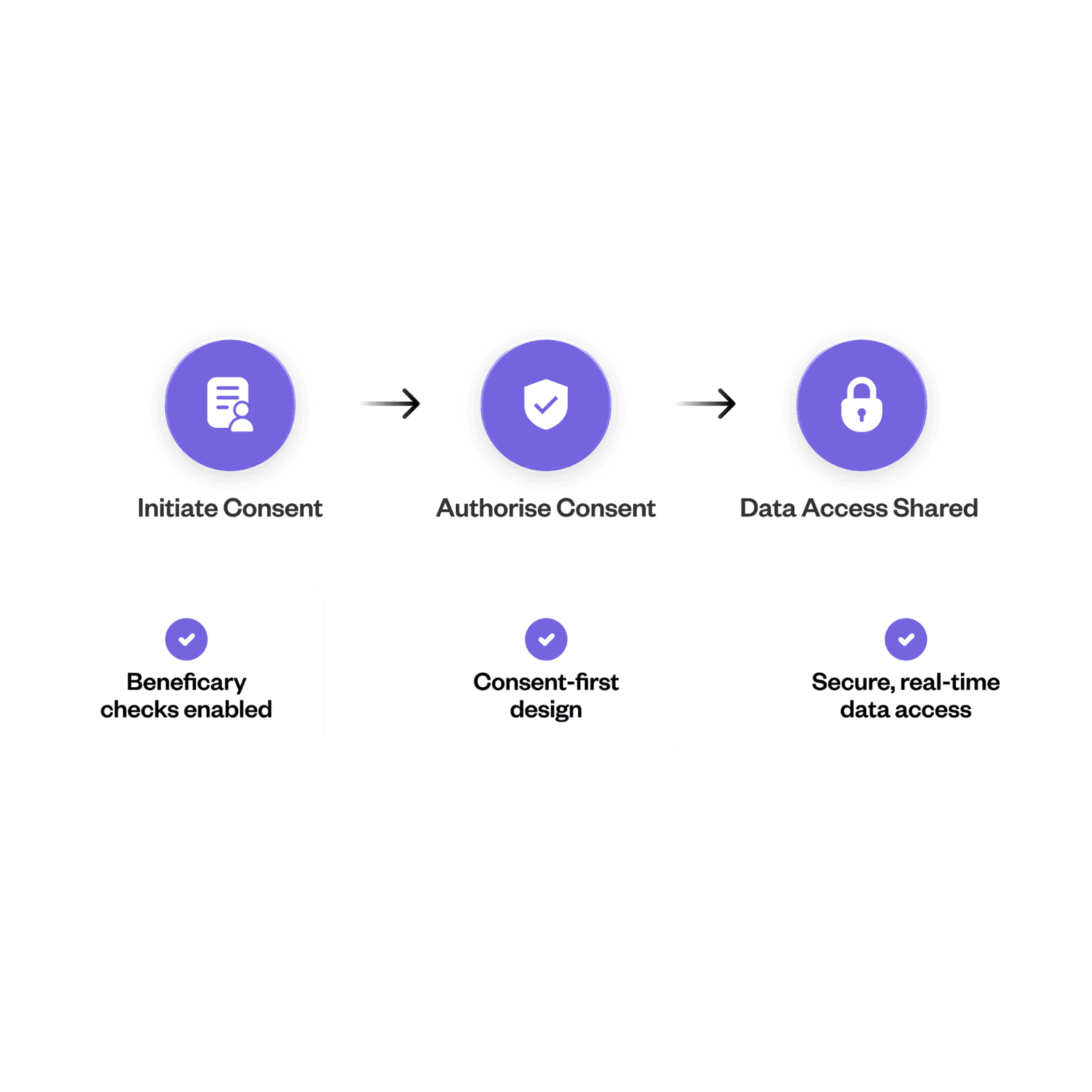

Consent-driven data access

- Secure, real-time, API-based access to account and transaction data.

- Support beneficiary checks and account verification.

- Build trusted, consent-based data experiences.

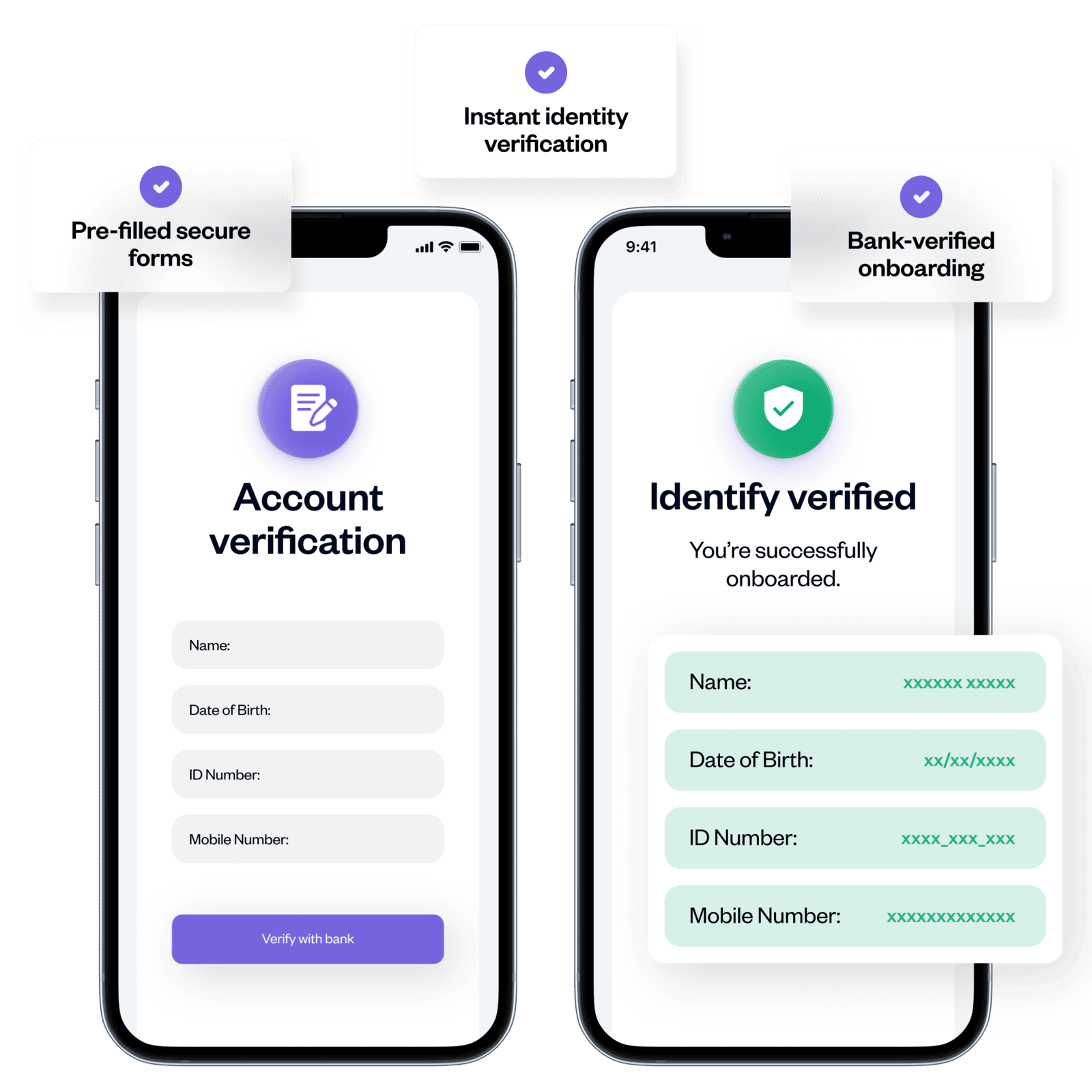

Improved customer onboarding

- Real-time identity and account verification.

- Pre-fill forms and faster identity checks through verified bank data.

- Reduce onboarding friction for individuals and SMEs.

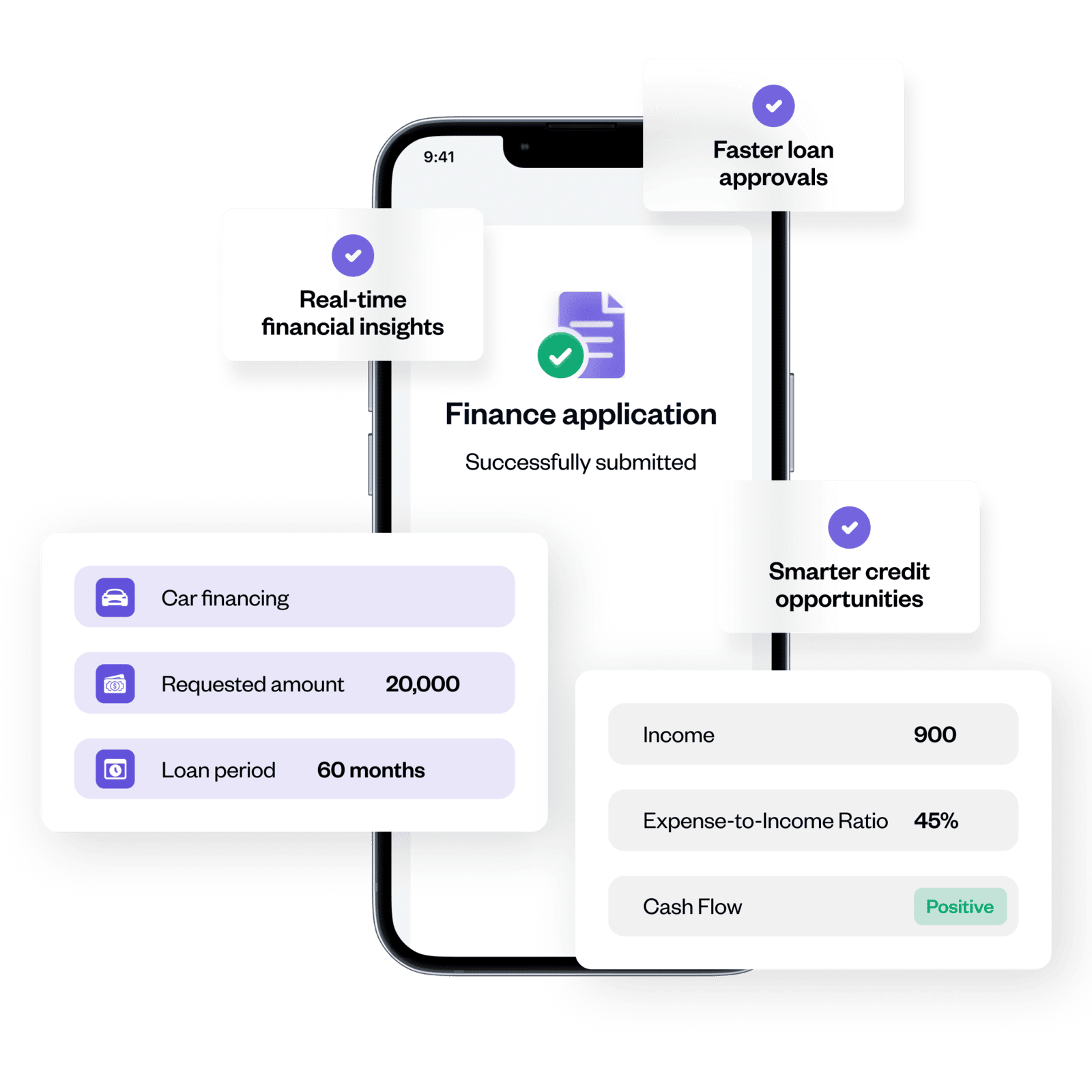

Smarter lending & credit decisioning

- Access income, expenses and cash flow patterns.

- Power BNPL, SME loans, and corporate credit products.

- Unlock lending opportunities for underserved customers.

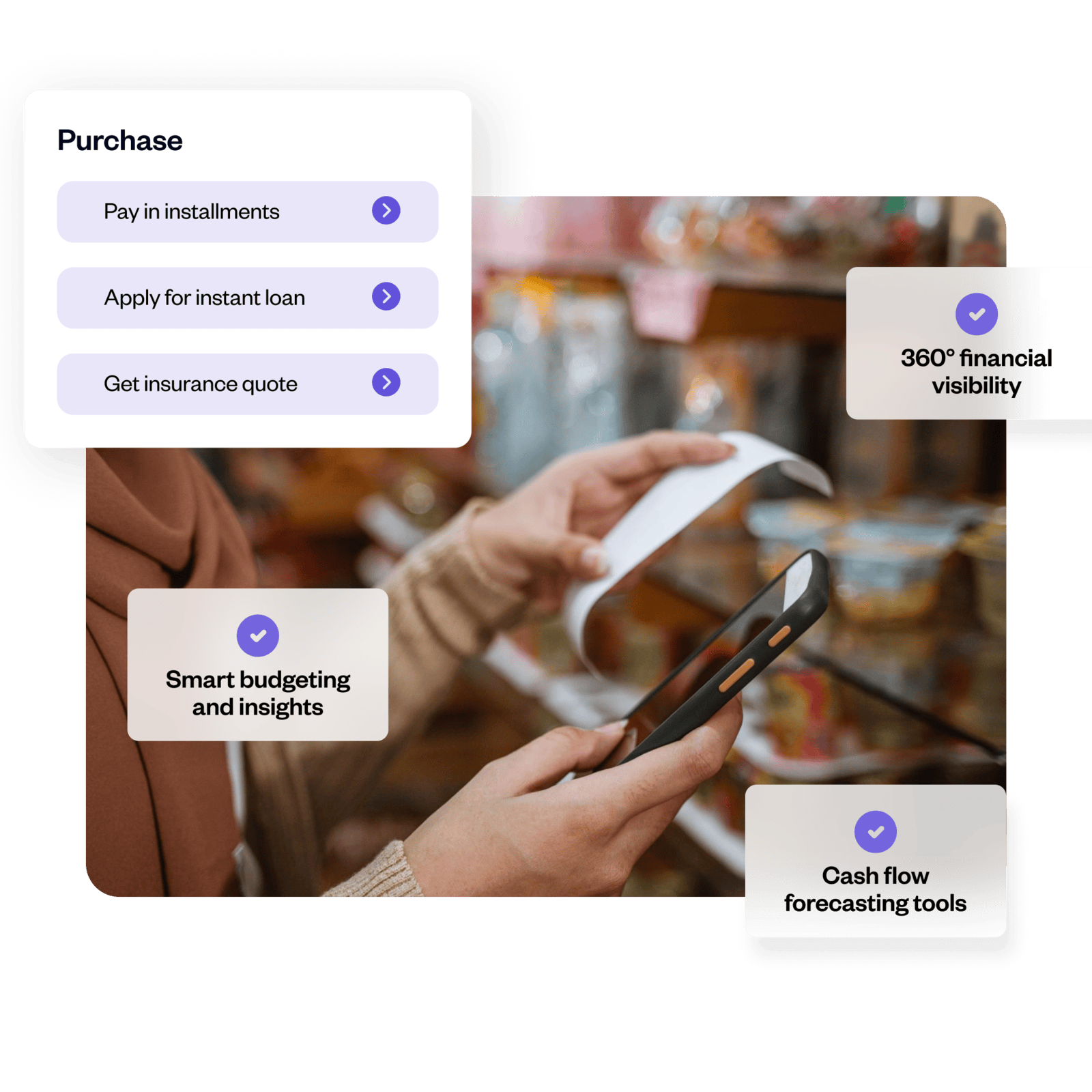

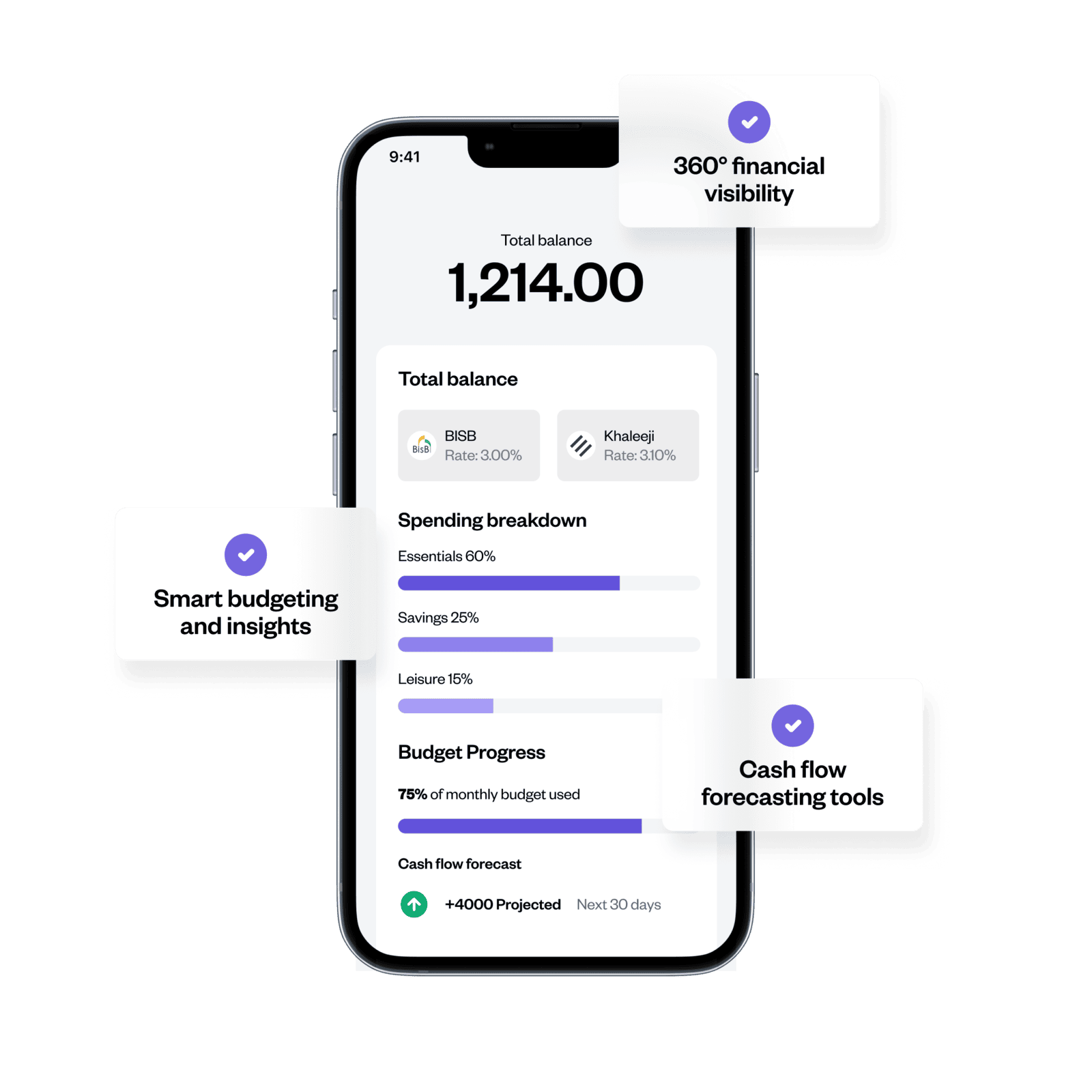

PFM & cash flow tools

- Aggregate accounts across providers for a 360 view.

- Deliver insights, personal budgeting and SME cash flow forecasting tools.

- Enable auto-investment platforms and financial wellness tools.

Embedded finance experiences

- Enable BNPL, lending, insurance or savings at point of need.

- Process payroll, disbursements, and invoice payments via PIS.

- Personalised offers based on live financial data.