Why partner with Tarabut?

How it works

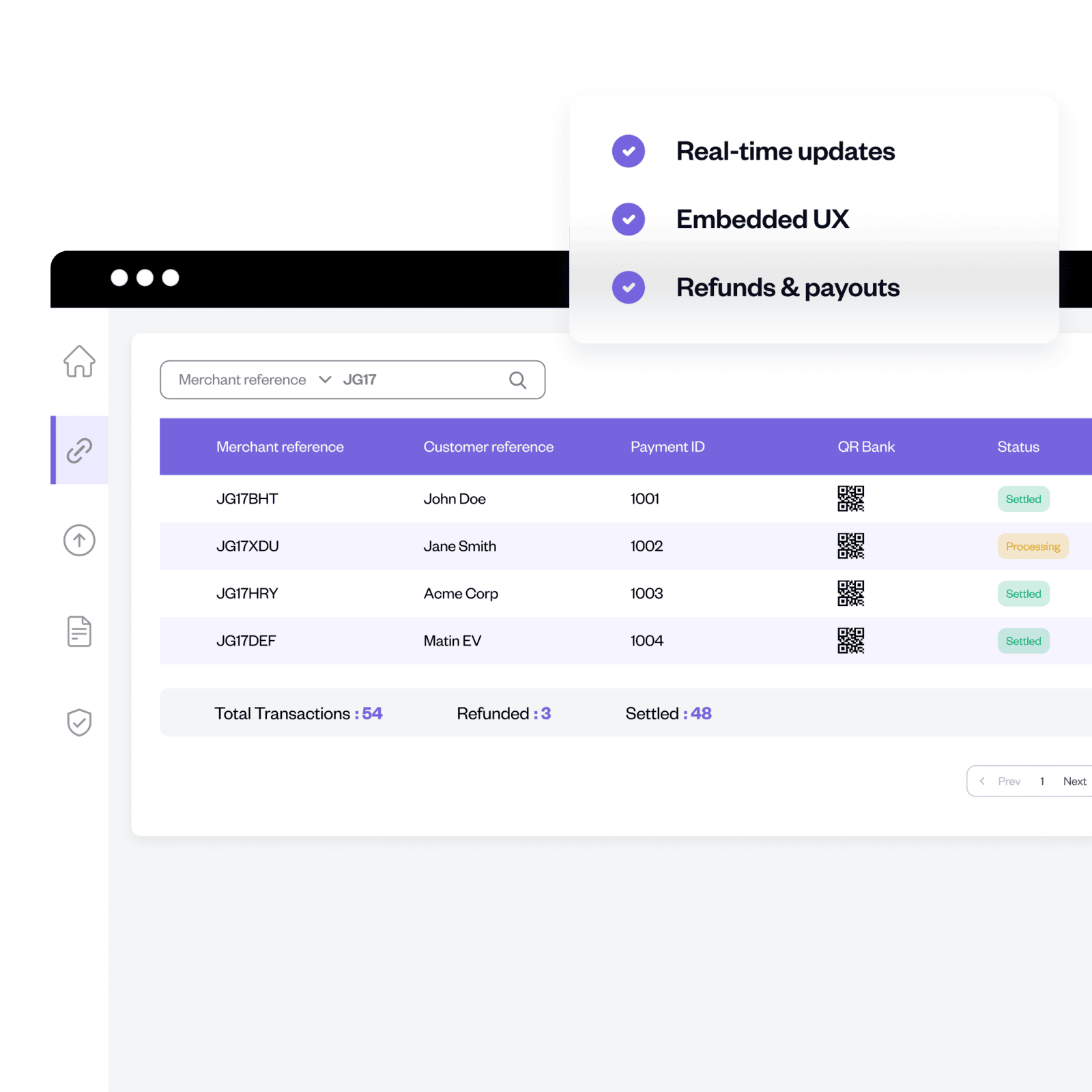

With real-time payment status notifications and a powerful reporting API, merchants can drive efficiency across their business by supercharging cash flow and increasing profitability.

Core capabilities

Who it's for

eWallets

Automotive

Cost saving, real time payments for deposit, purchase and after sales. From payment links to QR codes, online deposits to use vehicle payouts, enhance your customer's payment experience while reducing costs.

Financial Services

Improve customer experience with real-time payments. Give your customers the instant payments they want and keep more of the transaction fee.

Use cases

Use cases

Discover how Payments enable businesses to optimise finance operations while cutting costs.

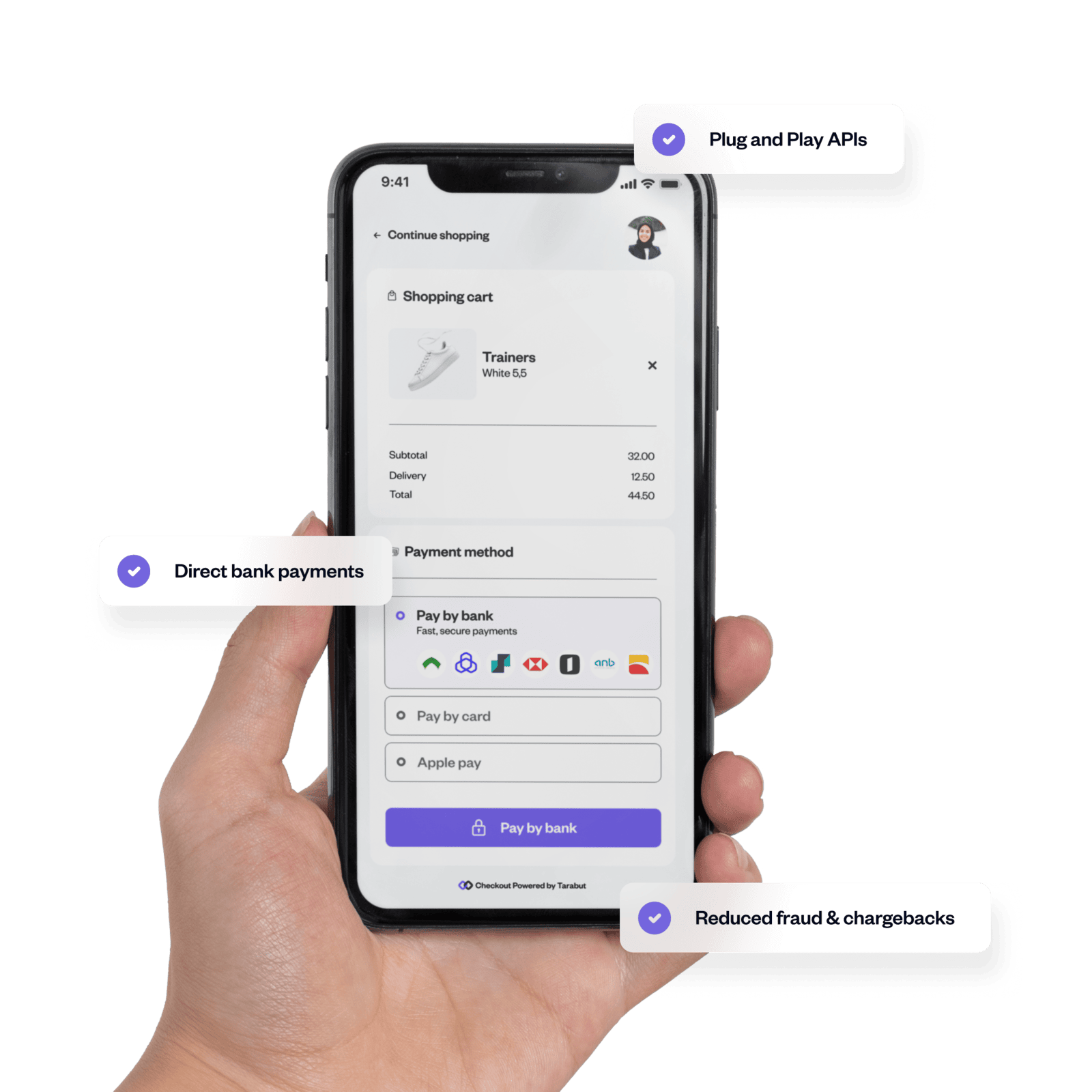

Seamless, online payment experiences

- Easily embedded via plug-and-play APIs and hosted UIs, enabling rapid deployment into existing checkout flows.

- Eliminate card fees and speeds up payments through direct bank transfers, lowering costs while reducing cart abandonment.

- Bank-level authentication drastically reduces fraud and chargebacks.

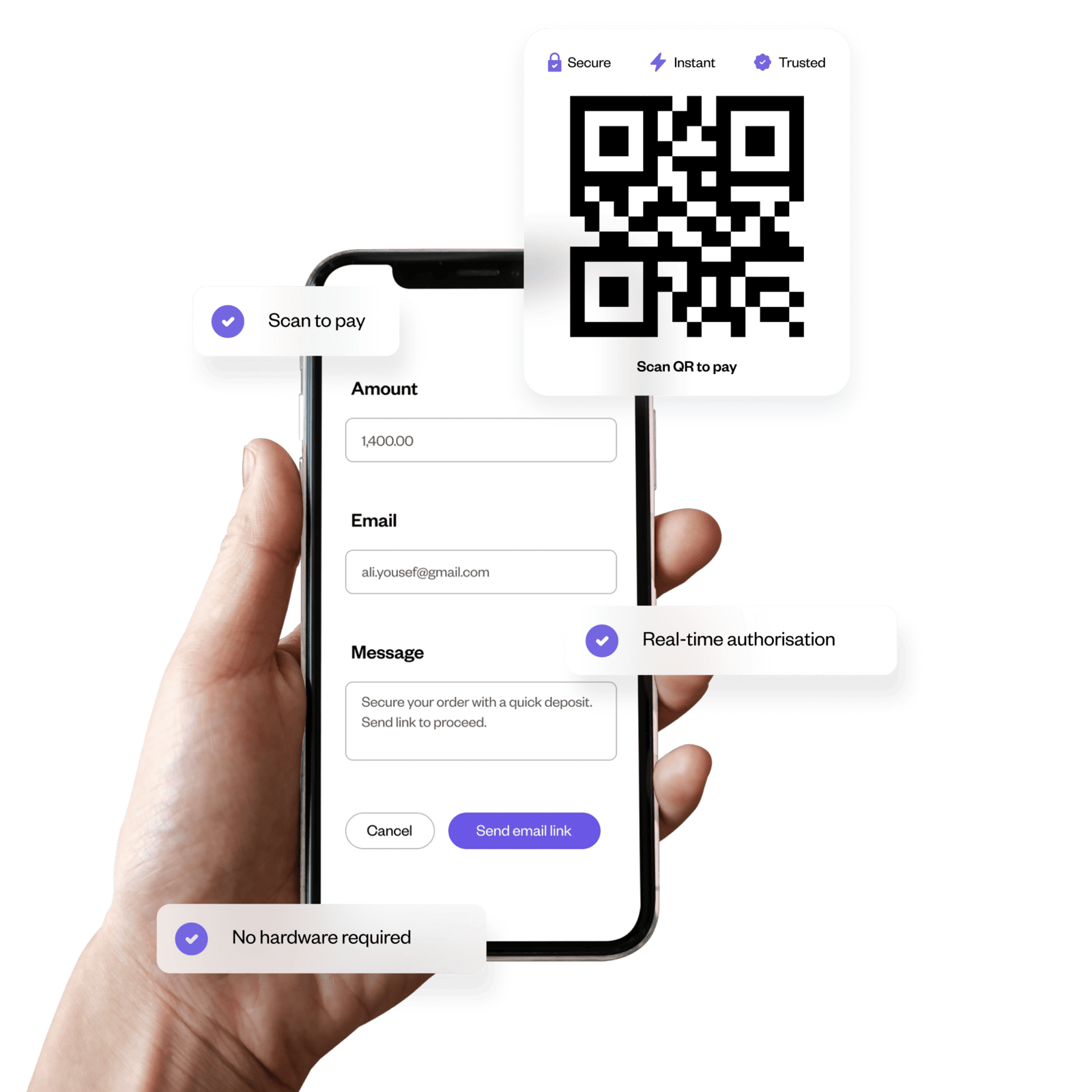

Real-time POS QR codes

- Customers scan a QR code to pay directly from their mobile bank app, enabling quick, card-free transactions with no hardware dependency.

- Bypasses traditional card networks to reduce processing fees, improving profitability.

- Bank-authenticated payments reduce fraud and chargebacks, while lightweight APIs allow for fast integration with existing POS systems.

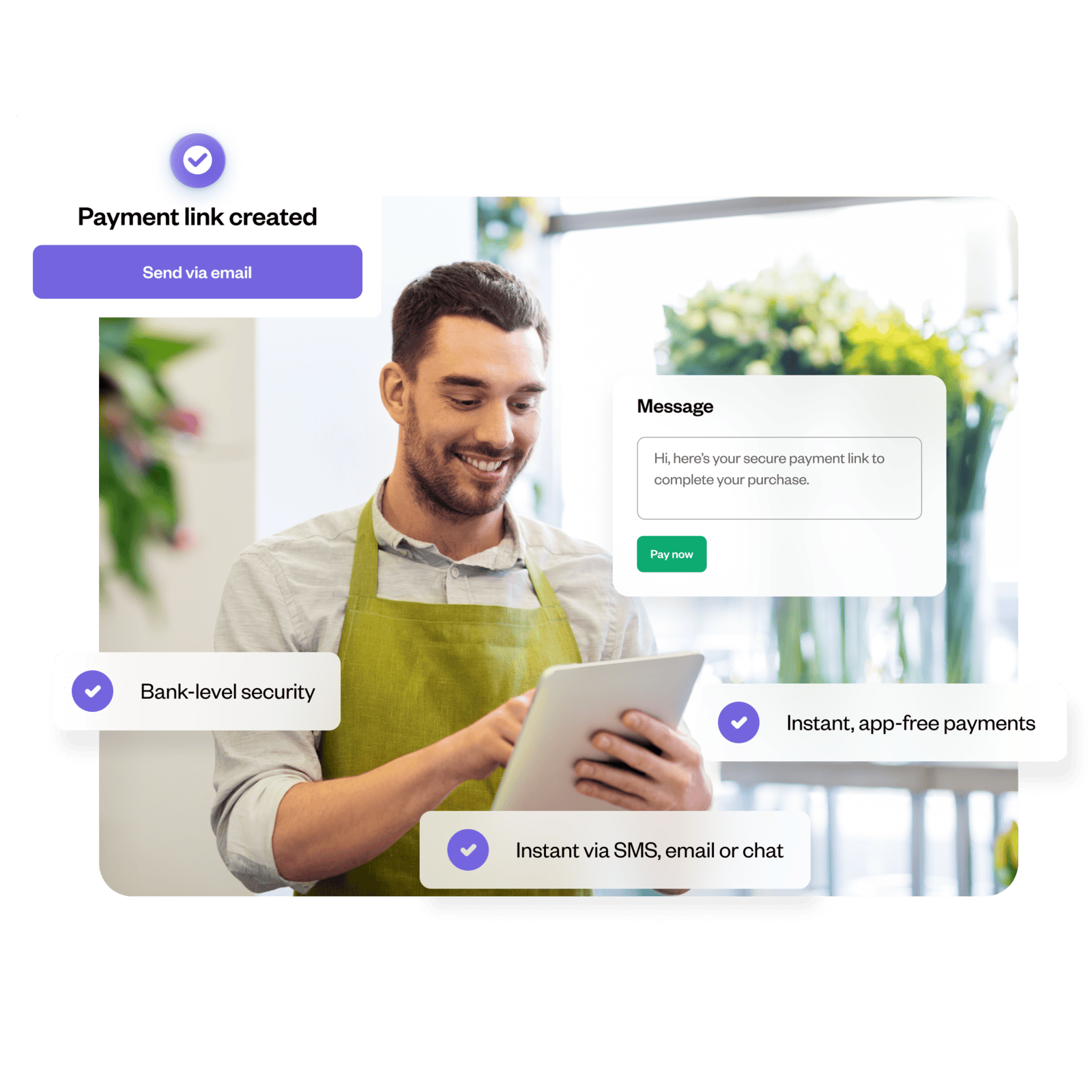

Conversion-boosting payment links

- Easily send payment links via email, SMS, or messaging apps, allowing customers to pay instantly from any device—no app or login required.

- Reduce reliance on card networks, cutting transaction fees and boosting margins.

- Bank-level authentication minimises fraud, to retain more revenue.

Real-time payouts and withdrawals

- Enable real-time payouts and withdrawals to users’ bank accounts without the delays of traditional payment rails.

- Avoid card and third-party payout fees while simplifying reconciliation and reducing back-office complexity.

- Bank-authenticated transfers ensure high security and compliance, enhancing user trust and minimising fraud risk.