31 May 2021 - Today’s digital savvy customers can access most financial services online. From opening bank accounts, saving and investing money, making payments, taking out loans – you name it, it’s all available with a few taps on their smartphones. Thanks to technology, banking has never been easier.

And if you look at it closely, the digitalisation of financial services has been driven largely by the advancements we’ve made in data analytics in recent years. Especially with open banking APIs becoming more regulated and mainstream, customer data is now readily available to banks and fintechs who are using data enrichment tools to extract meaningful customer insights from it.

This customer-focused approach is why digital financial services are being adopted at a rapid pace.

So, what do financial customers want?

Customers clearly prefer digital to conventional banking. In Saudi Arabia, for example, online banking penetration has been consistently increasing in recent years and is expected to reach around 68% in the next five years. And the Kingdom is not alone. Many GCC countries are exhibiting the same trend. Take Bahrain as another example. In the key Middle Eastern economy, digital banking adoption is expected to reach 51% by 2028.

And as we see it, Banks and fintechs that take the time to understand what the digital-age banking customer wants will be the ones best suited to capitalise on this digital banking boom in the GCC.

But what does the customer want from their digital financial services provider nowadays?

If you ask us, they want convenience with personalisation. They want data-backed insights and tailored recommendations from their financial services providers that give them a clear view of their financial health at all times and inform their decisions. In this uncertain economic climate, customers want to be in control of their finances, manage their spending, budget wisely, and diversify their incomes.

And with open banking, coupled with data analytics technology, banks and fintech have the opportunity to tap into the power of data to unlock actionable information for their customers and financially empower them. But there’s a catch…

Too much data is the same as no data at all

Thanks to open banking, banks and fintechs have an abundance of information about the financial activity of their customers. The challenge is to take those infinite rows and columns of data and convert it all into actionable insights and help customers make better decisions. At a minimum, open banking use cases can be leveraged to aggregate customers’ financial activity data and present them with a cohesive picture of their finances using simple data categorisation. This is what personal finance management apps do. They aggregate, categorise, and present.

But data categorisation at this level can be quite basic. It sifts through all the data and helps differentiate expenses from revenues and assets from liabilities. And that’s it. It lacks the granularity and accuracy required to inform decisions. Customers gain a high-level outline of their finances but lack useful insights that can guide their behaviour and help them improve their financial health. So, in the end, too much data ends up being the same as no data at all to the customer.

What banks and fintechs need to do is take customer data in its simplest form and enrich it with actionable insights. But how do you do that? Well, open banking has the answer to that too!

Data Enrichment: Turning Data Into Insights

Data enrichment is when we take data in its existing form and build on top of it to extract meaningful insights that signal behaviour patterns.

Think of data, arguably the most precious resource in the world, like crude oil, the second most valuable resource. And like crude oil, data in its raw form is of little use. It needs to be refined and enriched to become a valuable asset. Data enrichment is the process of doing just that. And open banking, coupled with A.I. and machine learning, is the underlying engine that makes the magic happen.

Simple, right?

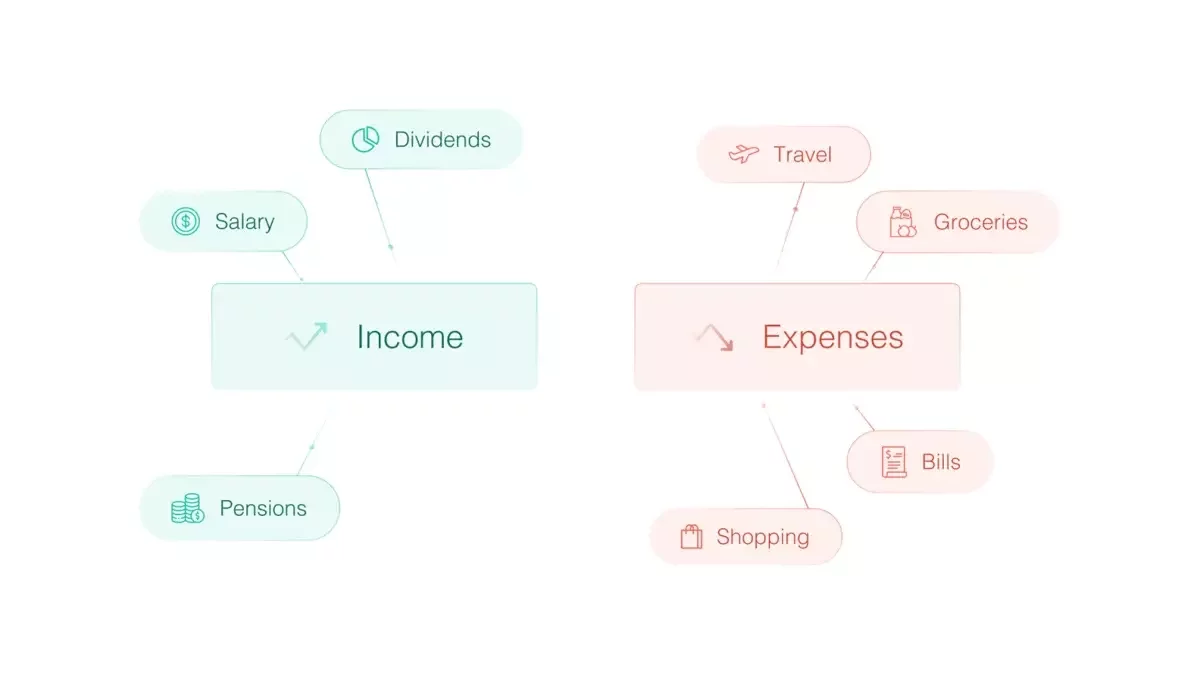

But the implications of data enrichment are quite powerful. Banks and fintechs can use open banking to not only access raw customer transaction data, which includes the description, timestamp, amount, and payment type, but also enrich it beyond simple categories. We can further split expenses into different buckets such as:

- Entertainment

- Groceries

- Bills

- Travel

- Shopping, etc.,

and do the same for income, categorising it further into:

- Salary

- Dividends

- Pensions, etc.

And that’s just the tip of the iceberg. Data enrichment using open banking allows us to go deeper. It helps map out a customer’s transactions geographically and even assess the carbon footprint of transactions. The possibilities are just endless.

With enriched data at their disposal, banks and fintechs are able to provide customers with unprecedented levels of insight and accuracy into their financial behaviour. All they need to turn these insights into actionable recommendations and advice is to use data analytics and A.I. capabilities.

How does data enrichment work?

To leverage open banking-led data enrichment, banks and fintechs can partner with an open banking platform with data enrichment tools. Take our 1st Party Data Enrichment (1DE) solution, for example.

First, we use our network of secure APIs to enable financial data sharing between different institutions and fintech businesses.

When a user provides consent to share their data with a fintech, our APIs establish an instant connection with the user’s bank account and retrieve the relevant account information and transaction activity data.

This is where our 1DE solution springs into action to process the data and enrich it with additional information, such as specific transaction categories and spending trends using machine learning algorithms.

The raw-turned-meaningful data is presented to the user and financial behaviour insights are unlocked.

The best part is this is an ongoing process. As more data comes in, the insights become more accurate, richer, relevant, and ultimately, more useful.

How does data enrichment benefit customers?

Data enrichment enabled by open banking can help individuals and businesses:

- Improve their overall financial health.

- Make sense of their data through extensive categorisation and clear visualisation.

- Make informed and smart financial decisions about investing, budgeting, and financial planning.

- Detect and avoid potential fraud or other financial risks.

Ultimately, data enrichment leads to a more robust and seamless experience that empowers customers.

How does data enrichment benefit banks and fintechs?

Open banking-enabled data enrichment provides financial institutions and fintechs some serious opportunities to innovate better products, streamline their operations, personalise their offerings, and ultimately, grow their bottom line and customer retention.

Consider these examples to see just how useful data enrichment is for banks and fintechs:

For banks:

Enriched data accessed through open banking is allowing banks to better understand customer behaviour and needs, and tailor products and services accordingly. With personalised experiences, banks are able to keep customers engaged and satisfied, resulting in higher retention and bottom line growth. What’s more is that the same insights are helping banks identify and capitalise on up-sell and cross-sell opportunities at the right time.

Let’s say the data insights unlocked by open banking indicate that a customer has been traveling more. The bank can offer that customer relevant travel products, such as special credit cards, travel insurance or foreign currency conversion. The use cases are simply endless!

For fintechs:

Fintechs are doing a great job of leveraging data enrichment to make financial services more accessible and innovative. Digital lending startups, and banks too, are using data enrichment to improve credit worthiness assessments of customers as they no longer need to deal with unstructured databases. They are also streamlining affordability assessments and making lending decision-making leaner, faster, and more efficient.

But the fintechs that have benefited the most, perhaps, are Personal Financial Management (PFM) startups. They are making full use of open banking use cases and data enrichment capabilities to aggregate all the different pieces of customer financial data in one place, categorise transactions more accurately, and provide deep insights into spending behavior in addition to personalised recommendations on how to best spend, save, and invest.

Let’s put this into perspective. Say, a customer using a PFM app has been spending too much on shopping in the last three months. This is an unusual trend given their typical spending behaviour. Data enrichment will allow the PFM provider to ping this anomaly, suggest alternatives, and provide budgeting tips to control their spending. The app can also offer alerts to the customer when they are about to reach their spending limit on shopping – all powered by open banking-led data enrichment’s capabilities. (Read our open banking for PFM article to learn more)

For insurance companies:

Insurance providers can now access more accurate and up-to-date financial information on their clients. They are using this information to gain a better understanding of customer behaviour and assess financial risk more efficiently. And with access to better customer risk profiles, they can underwrite better policies, improve pricing, and bolster their risk management. Insurtech companies are also using open banking-led data enrichment to reduce costs by improving data accuracy and automating manual tasks.

What’s the bottom line?

Open banking data enrichment is a powerful tool that is making financial services inclusive, accessible, and customised to the needs of every individual customer. It takes raw data, cleanses it, refines it, enriches it, and turns it into nuggets of gold that are accurate, informative, and actionable. The customer benefits from a personalised financial experience and feels empowered. Banks, fintechs, and other institutions enjoy higher engagement, retention, and business growth. It’s a win-win for all.

Looking to get the best out of your data? Get in touch with us to learn how our open banking tools are the right fit for you.

Relevant releases

Amazon Web Services and Tarabut Join ONE App to Enhance the Future of Digital Financial Solutions in Bahrain

ONE App, Bahrain’s first comprehensive digital financial marketplace, has announced the addition of Amazon Web Services and Tarabut to its list of key partners contributing to the development and enhancement of the user experience.