- Supporting Bahrain’s Vision 2030 to Empower SMEs and Drive Economic Growth by Addressing Financing Access Challenges for SMEs and Corporates

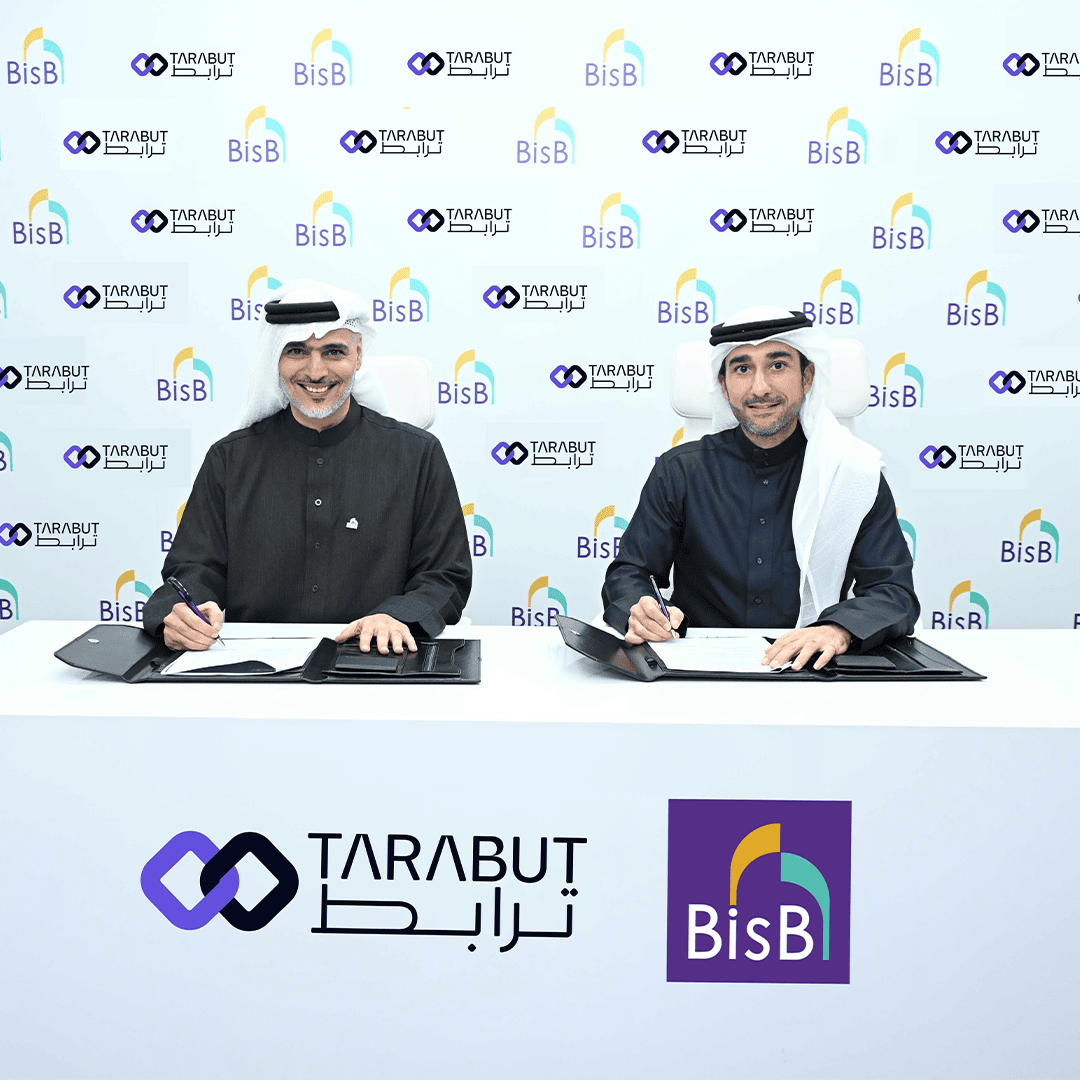

Manama, Kingdom of Bahrain – 02nd February, 2025: Bahrain Islamic Bank (BisB), the leading provider of innovative Islamic financial solutions for simplifying money matters in the Kingdom of Bahrain, has signed a Memorandum of Understanding (MoU) with Tarabut, MENA’s leading Embedded Finance platform, to develop a pioneering financing solution that helps SMEs and corporates access funding based on their daily Point-of-Sale (POS) transactions.

The proposed solution will adopt a unique revenue-based financing framework based on POS transactions that adjust financing repayments in line with businesses’ income streams, thereby helping businesses manage cash flow more effectively. With a digital application and approval process, businesses will be able to secure financing quickly, bypassing the lengthy procedures that are typically associated with traditional financing. This fast access will allow SMEs and corporates to meet their working capital needs and capitalise on growth opportunities without encountering the usual complexities.

Mr. Aqeel Mohammed Ghaith, Chief Corporate & Institutional Banking Officer at BisB stated: “Our collaboration with Tarabut is another milestone in our longstanding commitment to innovation and client empowerment. By introducing a revenue-linked financing model that adapts to business revenue streams, we are opening up new opportunities for SMEs and corporates to improve their resilience, grow with confidence, and contribute to Bahrain’s economic development.”

Mr. Abdulla Almoayed, Founder & Chief Executive Officer of Tarabut, added: “There is a real and ongoing challenge in how SMEs and corporates access financing, and at Tarabut we have the technology to change that, for the better. These businesses are the heartbeat of the economy, but the slow, complicated processes of traditional funding simply can’t keep up with their needs. That’s why we are working with innovation-led banks like BisB and key players across the ecosystem to develop something game-changing: revenue-linked financing technology that gives businesses faster, more flexible access to loans, to grow, thrive and make an even greater impact on the economy.”

Tarabut and BisB are working to introduce this unique setup to the Bahrain market, further enhancing the financial landscape for SME’s and Corporates.

The initiative reinforces BisB as a reliable partner for Bahrain’s SME and corporate ecosystem. By developing forward-thinking financial services that align with client needs, the Bank continues to support long-term business success and economic progress in the Kingdom.

Relevant releases