Why partner with Tarabut?

How it works

Real-time insights delivered through a powerful, intuitive dashboard and/or API integrations.

Core capabilities

Tarabut's Data solutions are hosted on Tarabut Cloud, with on-premise deployment available for select enterprise customers.

Who it's for

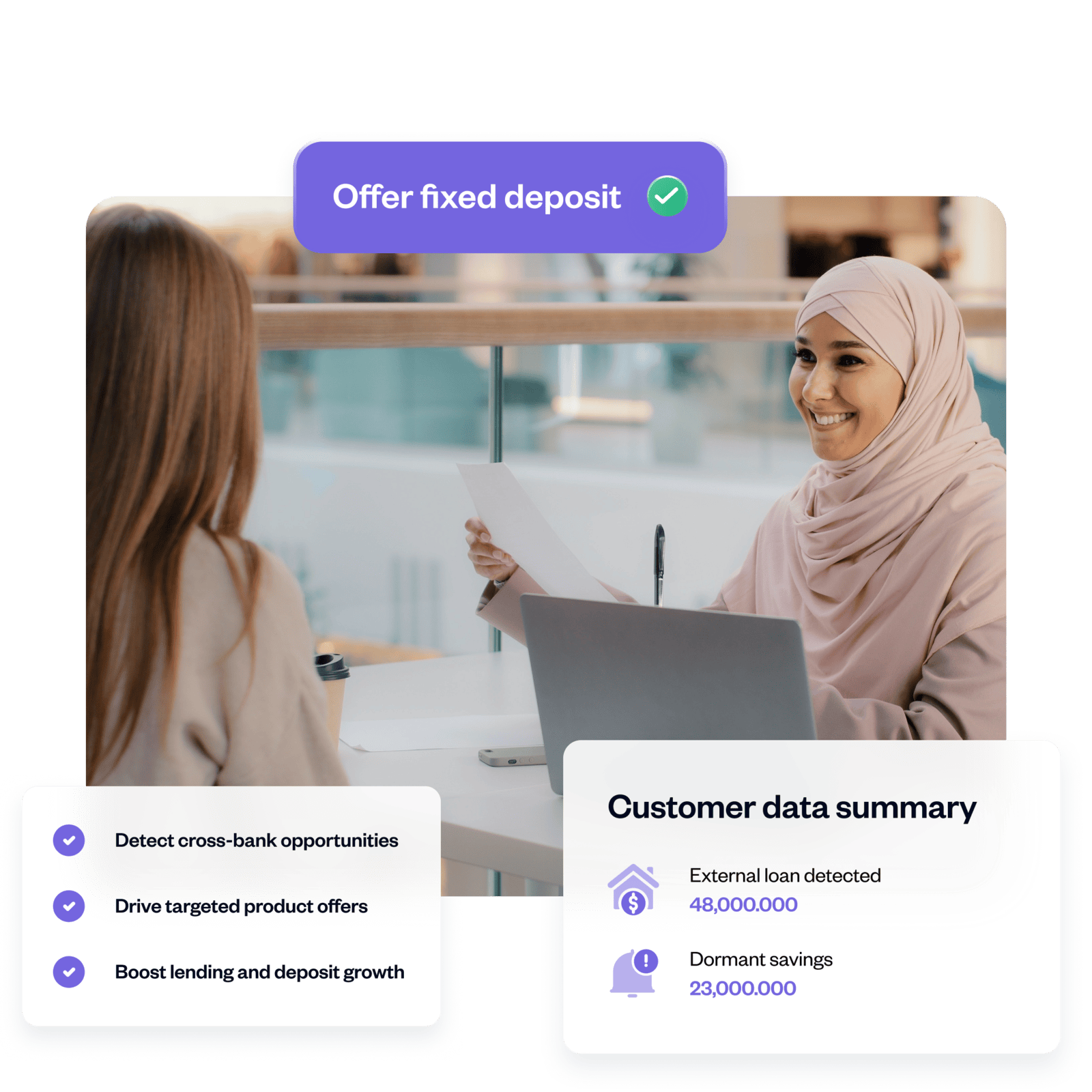

Banks

Accelerate lending, deposits, and card adoption with data-led targeting. Identify the right customers, create high-intent segments, and launch personalised campaigns that drive measurable growth.

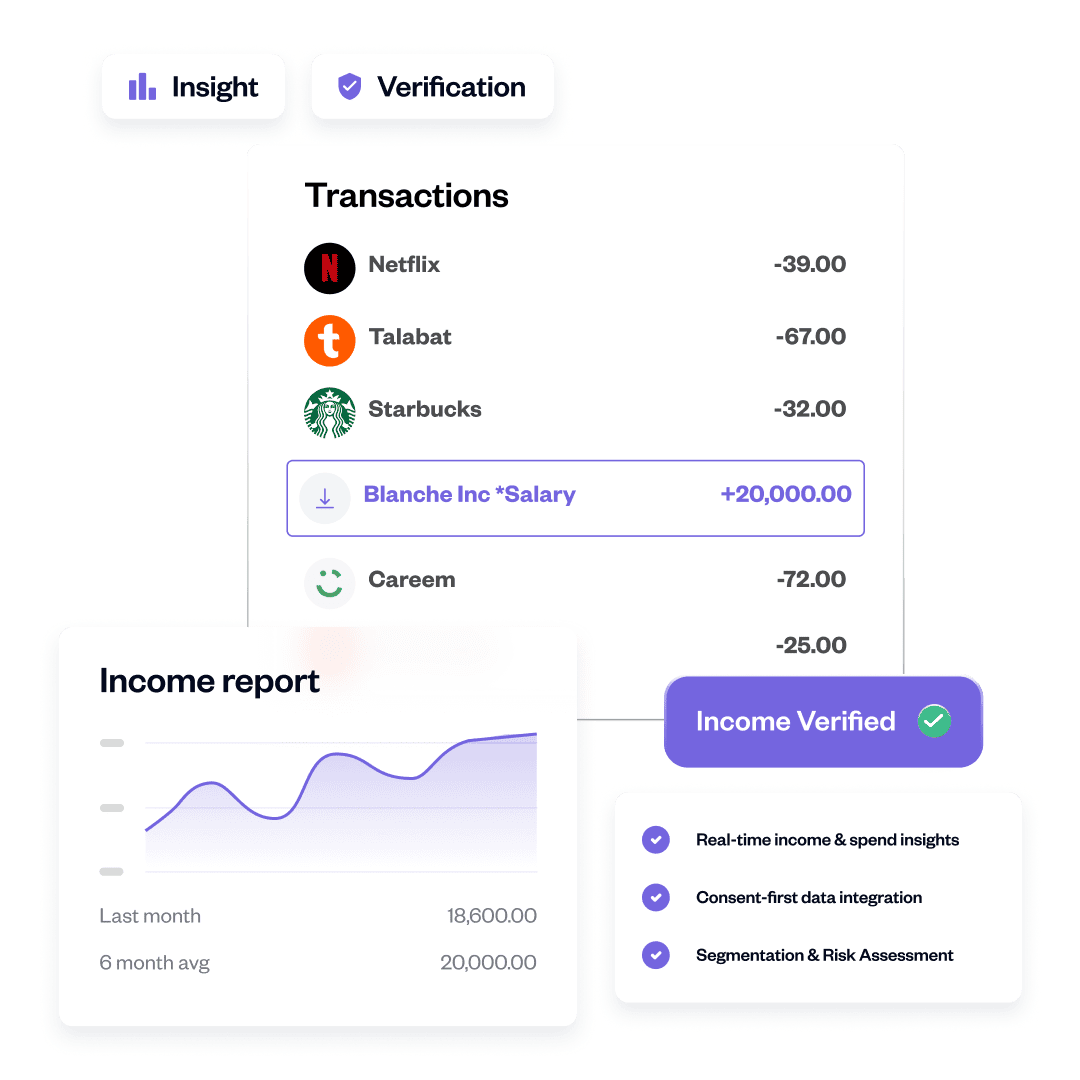

Lenders

Streamline lending decisions by lowering acquisition costs, leveraging alternate risk data, and targeting borrowers with relevant products.

Investment firms

Deepen client relationships and unlock upsell opportunities with data-driven insights. Leverage real-time financial behaviour to tailor offerings, anticipate needs, and deliver more value to every client.

Use cases

Use cases

Discover how Tarabut data solutions enable strategic, data-driven decisions.

Lending and deposits growth

- Improve conversion rates on unsecured lending

- Proactively offer better loan terms or deposit products

- Detect opportunities for balance consolidation

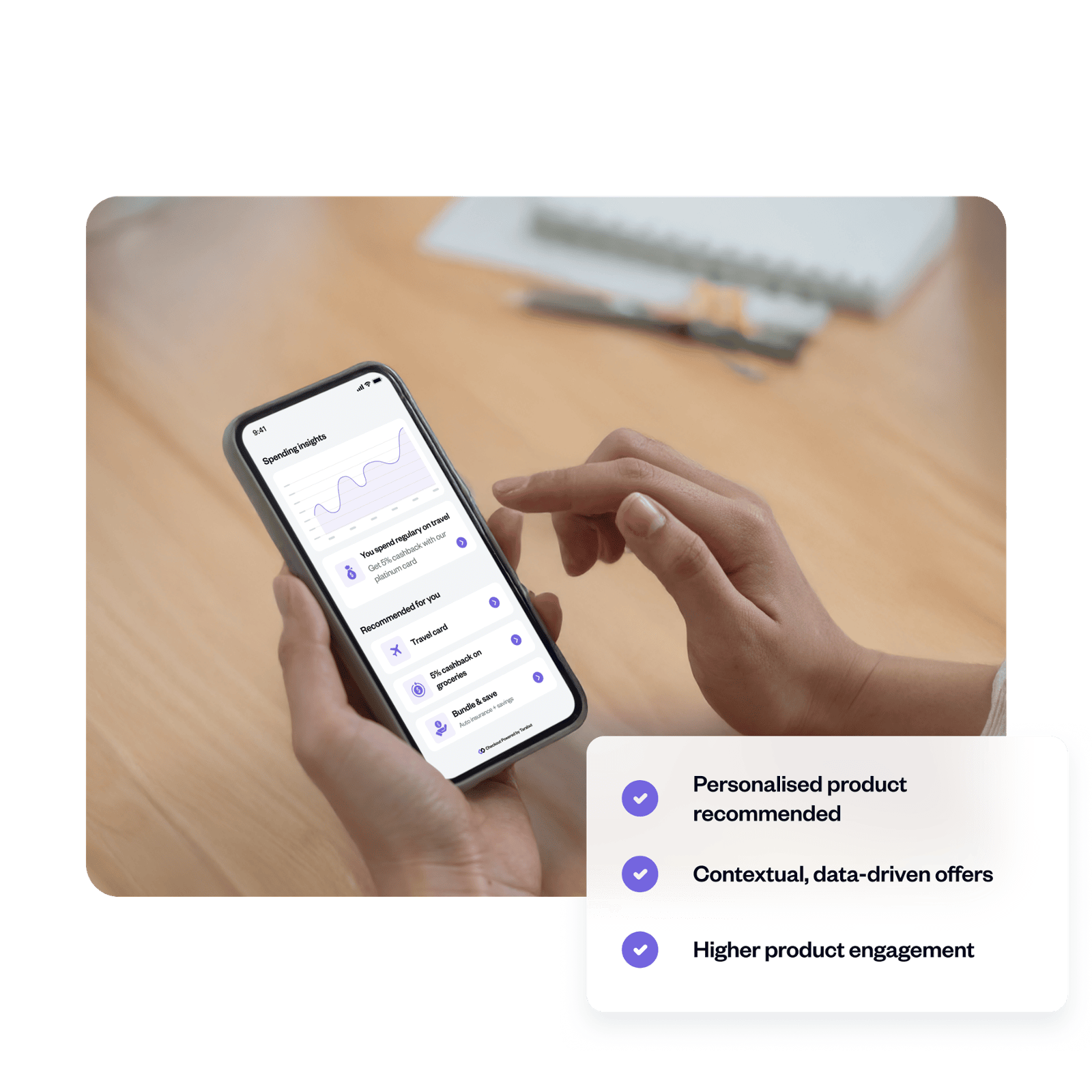

Cross-selling and upselling

- Surface personalised product offers based on spending patterns

- Recommend bundled services tied to customer needs

- Increase product holding per customer

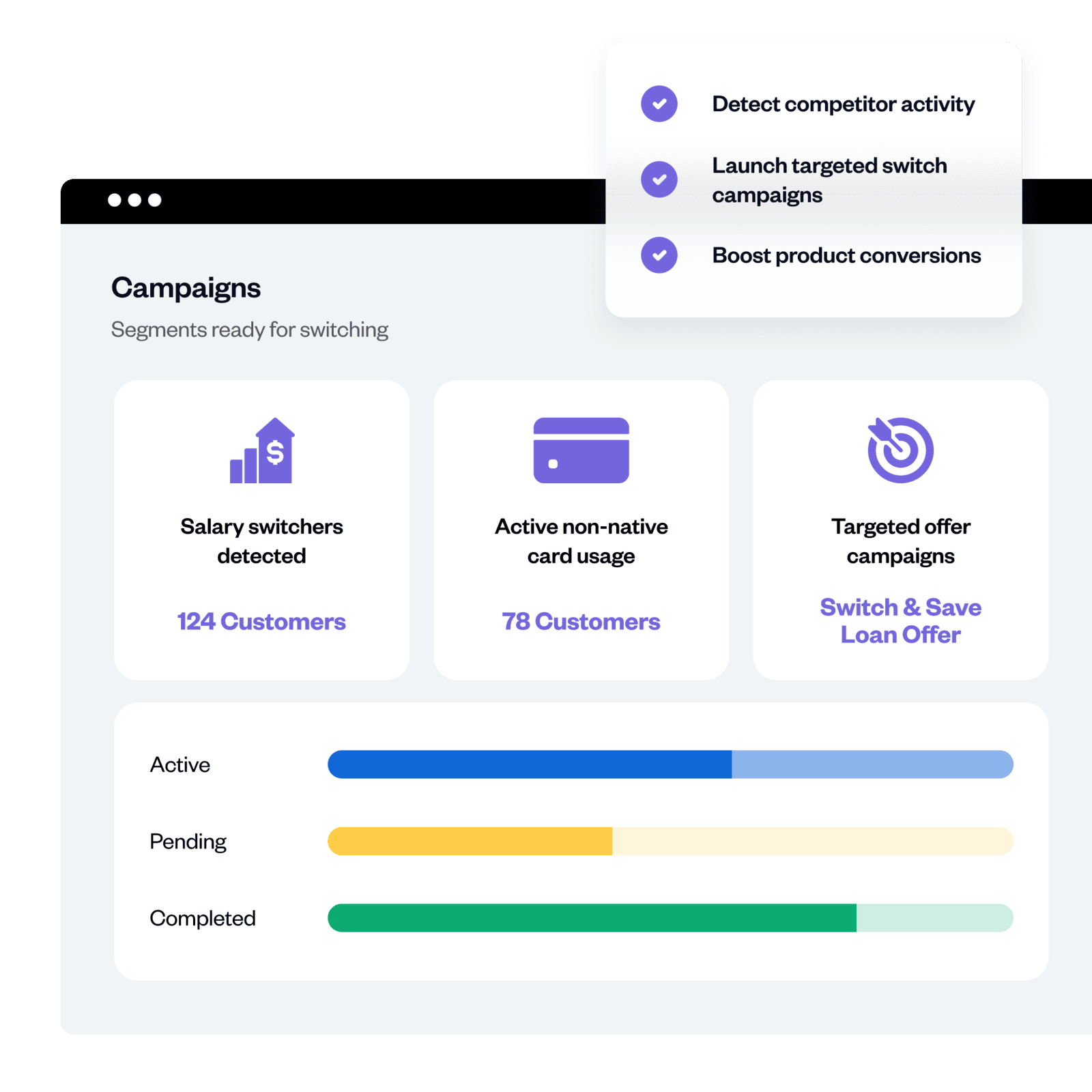

Switch and conversion campaigns

- Identify salary switchers and offer incentives

- Detect active usage on competitor cards

- Launch focused product conversion journeys

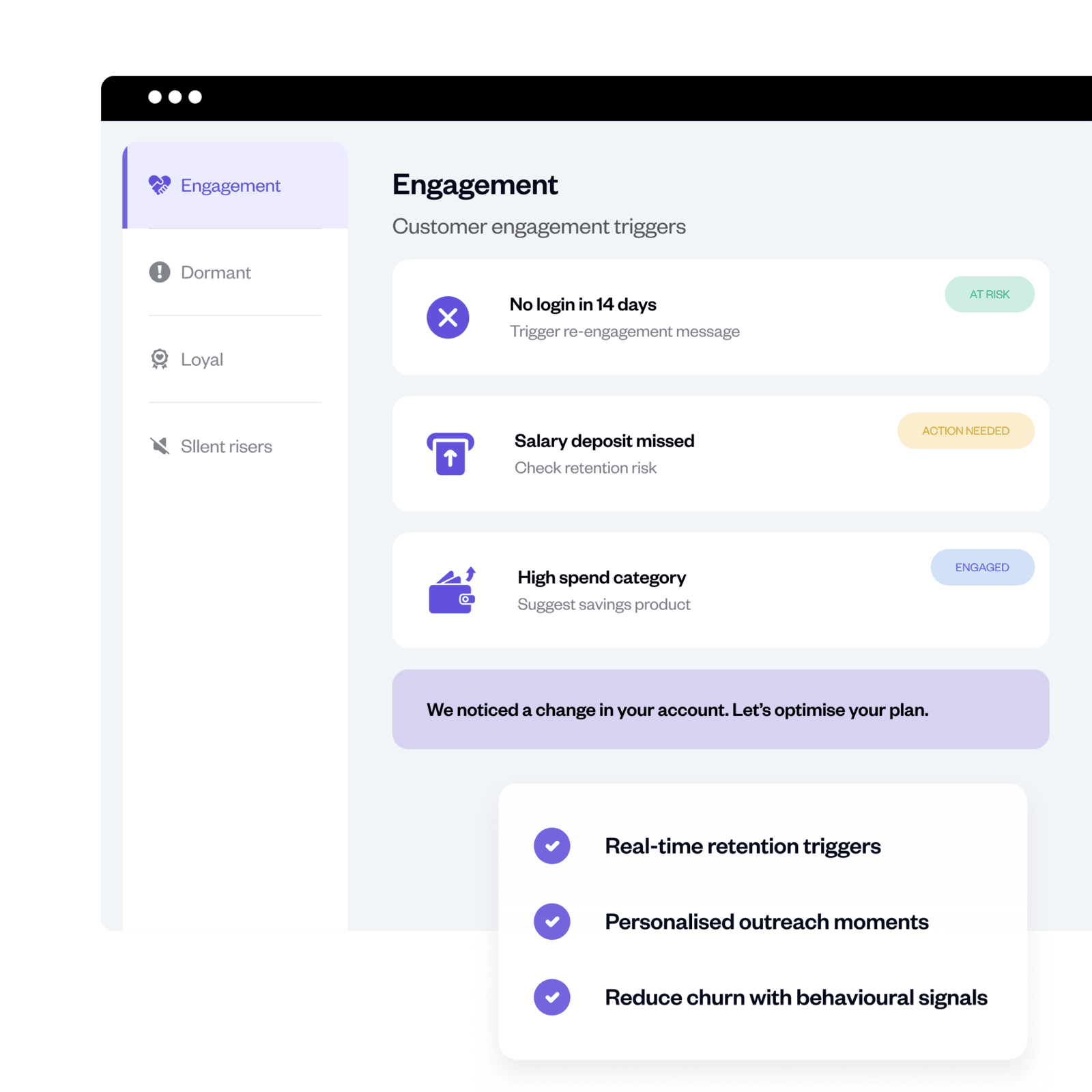

Customer engagement & retention

- Use life-stage or behaviour signals to drive re-engagement

- Reduce churn with early signals from account activity

- Deliver value-based communications instead of generic messaging

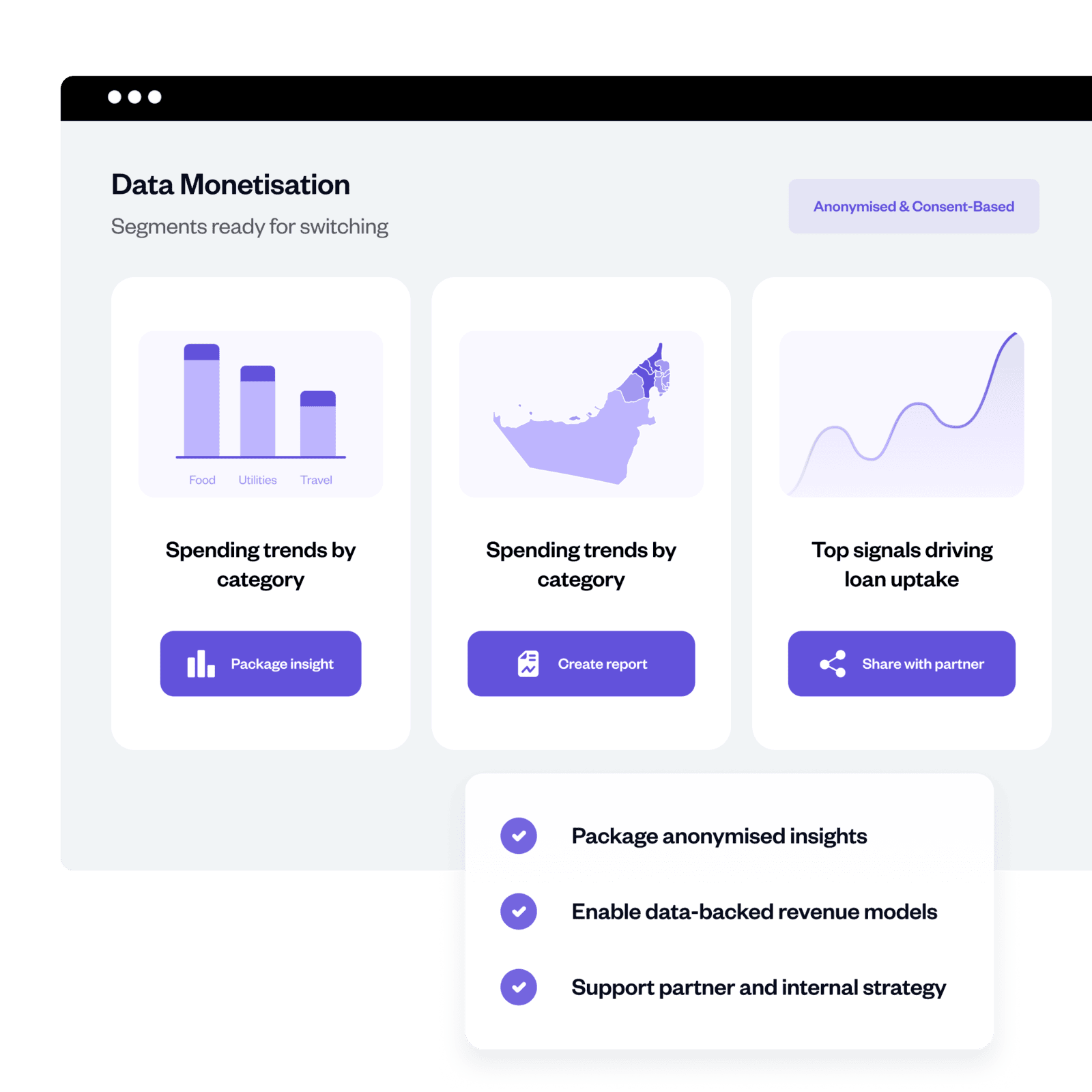

Data monetisation

- Package anonymised trends for internal or partner use

- Inform product development and pricing strategies

- Enable new commercial models backed by consented data