We are still in the early days of open banking adoption in MENA with several countries introducing regulation and more preparing to follow. The doors ...

We are still in the early days of open banking adoption in MENA with several countries introducing regulation and more preparing to follow. The doors to the data vaults are opening, representing a considerable reduction in barriers to market entry for third parties. The ability to aggregate, extract and analyse a wealth of data by a range of actors will lead to innovation and service enhancement and transform the traditional banking model in ways we cannot yet imagine.

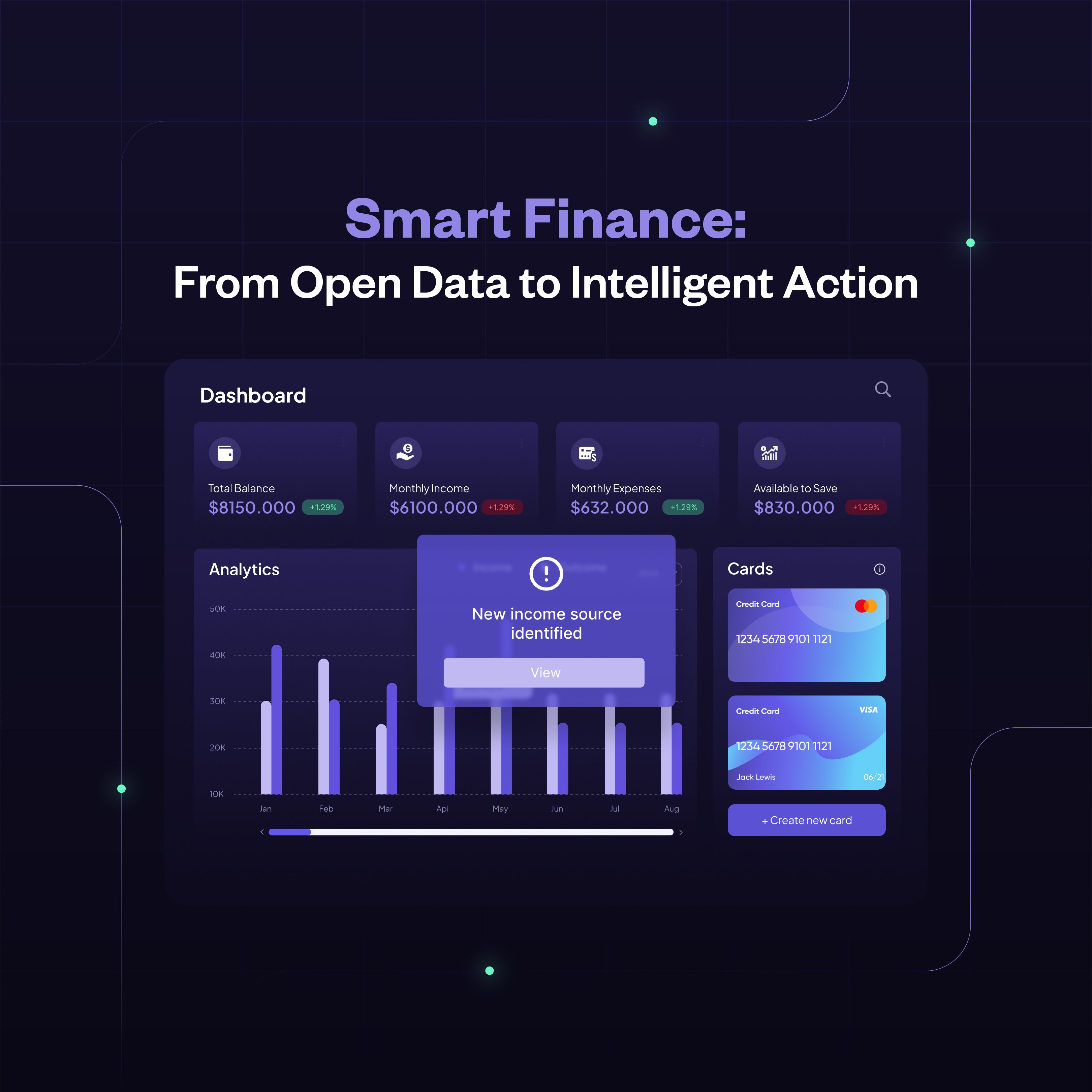

Even though open banking is still in it’s infancy, we already see a natural progression from open banking to open finance, which should eventually lead to open data. As internet connectivity strengthens and spreads, the cost of doing business is expected to fall. We will see the rise of so many new initiatives and enterprises, ambitious for change and the levelling of the competitive landscape.

Imagine the potential to innovate and create solutions that respond with efficiency and speed to seemingly impenetrable social and human challenges. It is an exciting time, and the journey from open banking to open finance and, eventually, open data will provide many opportunities and meet needs we didn’t know we had.

How do businesses start preparing for this future? What’s next?

First, let’s clarify each concept.

The regulation behind open banking is designed to simplify banking for consumers and increase their options. Open banking also allows the sharing of regulated banking data with fintechs and other third-party service providers through an application programming interface (API), an encrypted code that serves as a connecting bridge between two software programs. This enables non-financial organisations to partner with banks to provide an enhanced customer experience, reduce friction and empower decision-making using insights from a wealth of banking data. Consumers can also share and access their data securely through these encrypted codes, allowing them to navigate their financial information like never before. While banks will continue to store and manage customer data, it is the consumer who is in control of that data and who can access it.

Benefits of open banking for consumers include:

Access to data and automated technology also provides benefits for banks, fintechs and other third-party providers, such as:

Open finance differs from open banking because it goes beyond bank data to include other financial data. It enables the sharing of financial data from banking and non-banking sources, including current accounts, savings accounts, mortgages, pensions, insurance, and utility bills

Open finance expands on the benefits of open banking by providing for increased competition in financial services and boosting customer service and solutions for various needs. It offers incredible potential to change the financial services environment and substantially improve financial inclusion for marginalised communities.

Benefits include:

Open data includes all other relevant data sources such as email, social media, health and travel logistics, in addition to everything we’ve just mentioned earlier. It also refers to the ability to combine financial data with non-financial data, for example, government, healthcare, and retail, to produce innovative and streamlined services. Mortgage providers, for example, can access non-financial data using automated tools that provide calculated, detailed risk reports in seconds. This increases the probability of a successful mortgage application for people who have traditionally struggled to access these services, with answers given almost immediately.

Access to data that is then mined with sophisticated, automated tools will unearth a wealth of intelligence that can be used to improve services and solutions everywhere.

Benefits include:

To summarise, open banking focuses on payment accounts and transactions, open finance goes beyond payment accounts to focus on financial services beyond banking, and open data will impact the service provision ecosystem.

Even if you’ve never bought a house, everyone knows that the process is emotionally charged and stressful, filled with financial, legal and logistical challenges. House buyers negotiate with many officials and representatives including estate agents, mortgage lenders, utility providers, telecommunications companies, and more. All these interactions require the same verified information in different formats, which can be challenging to gather.

What if we could simplify the process through one point of contact? Access to banking and financial data allows an entrepreneurial fintech to gain an understanding of pain points, risks and duplicated processes, which helps to design a service that substantially streamlines and enhances the customer experience. A licenced third party, an estate agency, for example, collaborating with or acquiring links in the house-buying process, can use data to offer a package deal that reduces cost, time, and stress for the consumer. The use of open finance and open data will provide insights that help redesign and optimise the customer journey. Imagine instant credit approval and responses from key agencies involved in the move without having to contact each separately? Data can even pick the best time to navigate traffic on moving day with a full furniture truck.

With approximately 2.5 quintillion bytes of data created daily, the potential is significant, and open banking is just the beginning. Access to data will allow businesses, banks and third parties to innovate on a massive scale, creating value in ways we cannot yet imagine, and help unlock open data economies that offer endless benefits.

If ever there was a compelling argument for the incredible power of data to transform, it is the impact of open banking on the banking sector. This transformation can act as an incredible template and catalyst for the creation of open data economies. Open banking is the starting point to an open, data-driven future.

You’re one connection away from unlocking millions of data points through one seamless integration – TG Connect! Gain access to unrivalled data coverage and enriched insights while ensuring secure and compliant data sharing to enhance your customer experience and power your products and services. Contact us to learn more about TG Connect, or sign up to our Developer Portal to start testing and building the next big financial solution powered by open banking.

Sign up here to receive news and updates.