Powering next-gen payments for Remittance

Simplifying cross-border payments with smart, fast account-to-account payments powered by Open Banking

TRUSTED BY

TRUSTED BY

Fast, secure, and cost-effective global transfers

Our payment solutions empower remittance providers to deliver faster transfers, lower transaction costs, and create a seamless experience for your customers.

Real-Time Payments

50%

Savings

Up to 50% savings compared to card payments with funds that arrive in milliseconds.

96%

Appectance

Up to 96% payment acceptance rate, enabling businesses to maximise growth and adoption.

34

Milliseconds

Payments land in merchant accounts in milliseconds, there are no pending payments.

Start taking cost-saving payments today

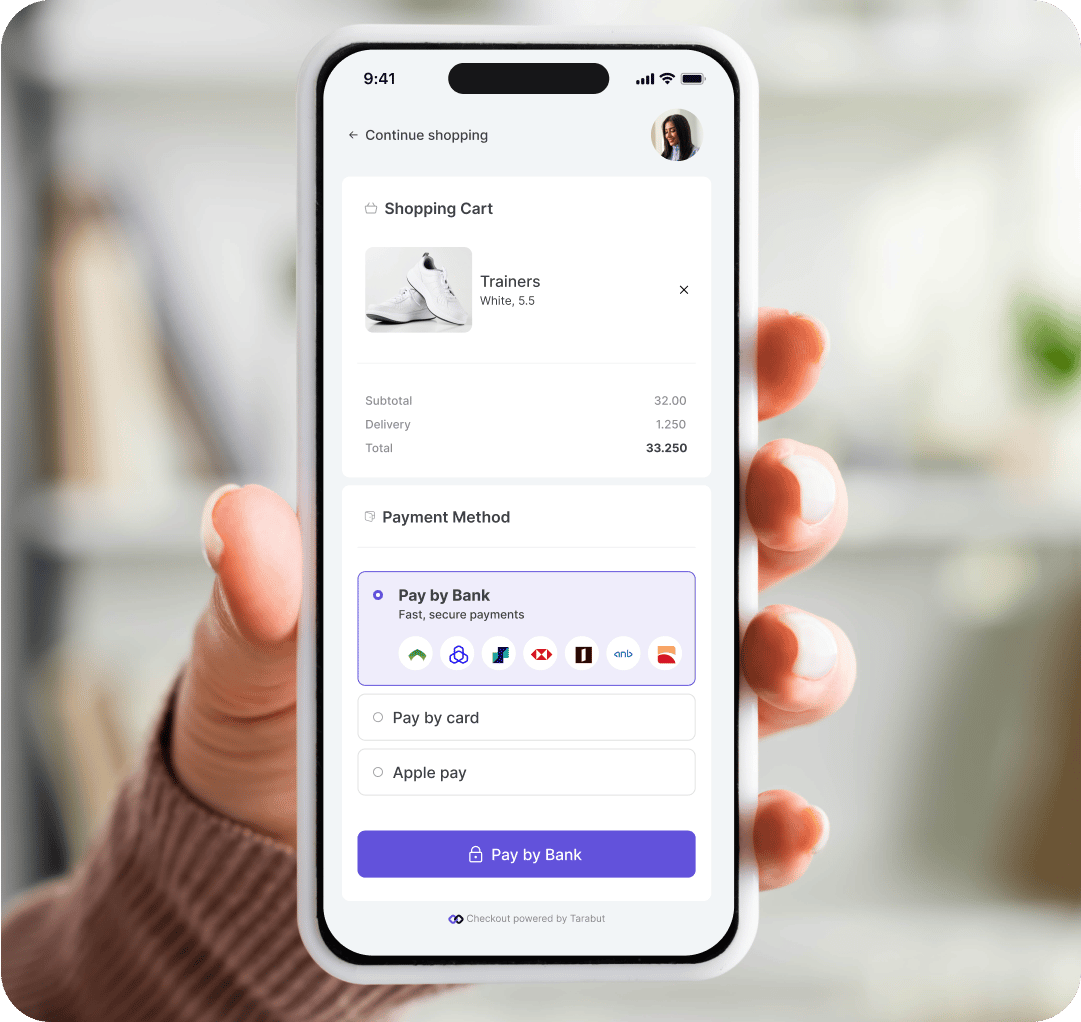

Payment options that meet your everyday needs

Supercharged payments

The fastest and easiest way to collect one-off payments.

- Real-time payments: Better manage cash flow with instant payments and real-time reconciliation.

- Instant refunds: Provide better customer experiences with full and partial refunds.

- Effortless reconciliation: Simplify and control the flow of funds including payments, refunds, payouts and fees.

Results that make a difference

.png?width=2000&name=b-a-exchange-case-study-cost-saving-stat-(1).png)

Save big on transaction fees

For B A Exchange, saving costs on high transaction fees was the main priority when searching for an Open Banking partner as they were looking to combat this issue to significantly reduce fees for their customers.

“With Tarabut, we’re saving around 87% on transaction fees compared to card payments. Since adding Tarabut Pay with bank to our checkout, we’ve noticed a significant transformation in our business as we’re no longer affected by high-cost card fees, meaning we can continue investing in improving our customer experiences.”

Azad Kamrul, Director & CEO at B A Exchange

Start taking cost-saving payments today

Build with us

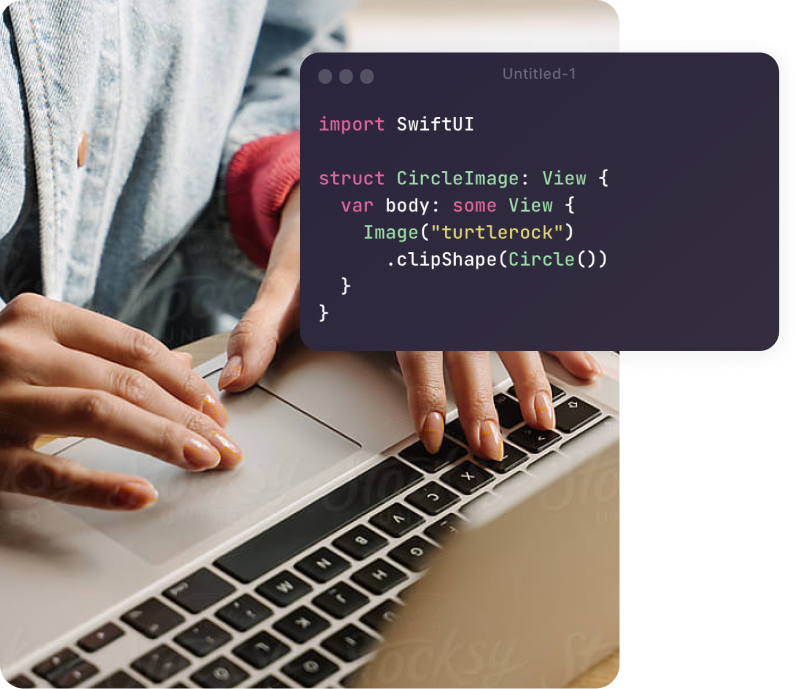

This one’s for the developers!

Extensive API Coverage

Gain access to an extensive collection of powerful APIs covering various financial services and functionalities.

Simplified Integration

Easily integrate our APIs into your fintech solutions using developer-friendly tools and documentation, reducing development time and effort.

Dedicated Developer Support

Prompt and reliable assistance from our experienced support team to help overcome any challenges and ensure a smooth development experience.

Secure Sandbox Environment

Test and validate your applications in a secure sandbox environment, ensuring optimal performance and reliability before launching.