TRUSTED BY

CHALLENGE

Manual Processes and Integration Hurdles

SOLUTION

Seamless Access to Financial Insights

How it works

-

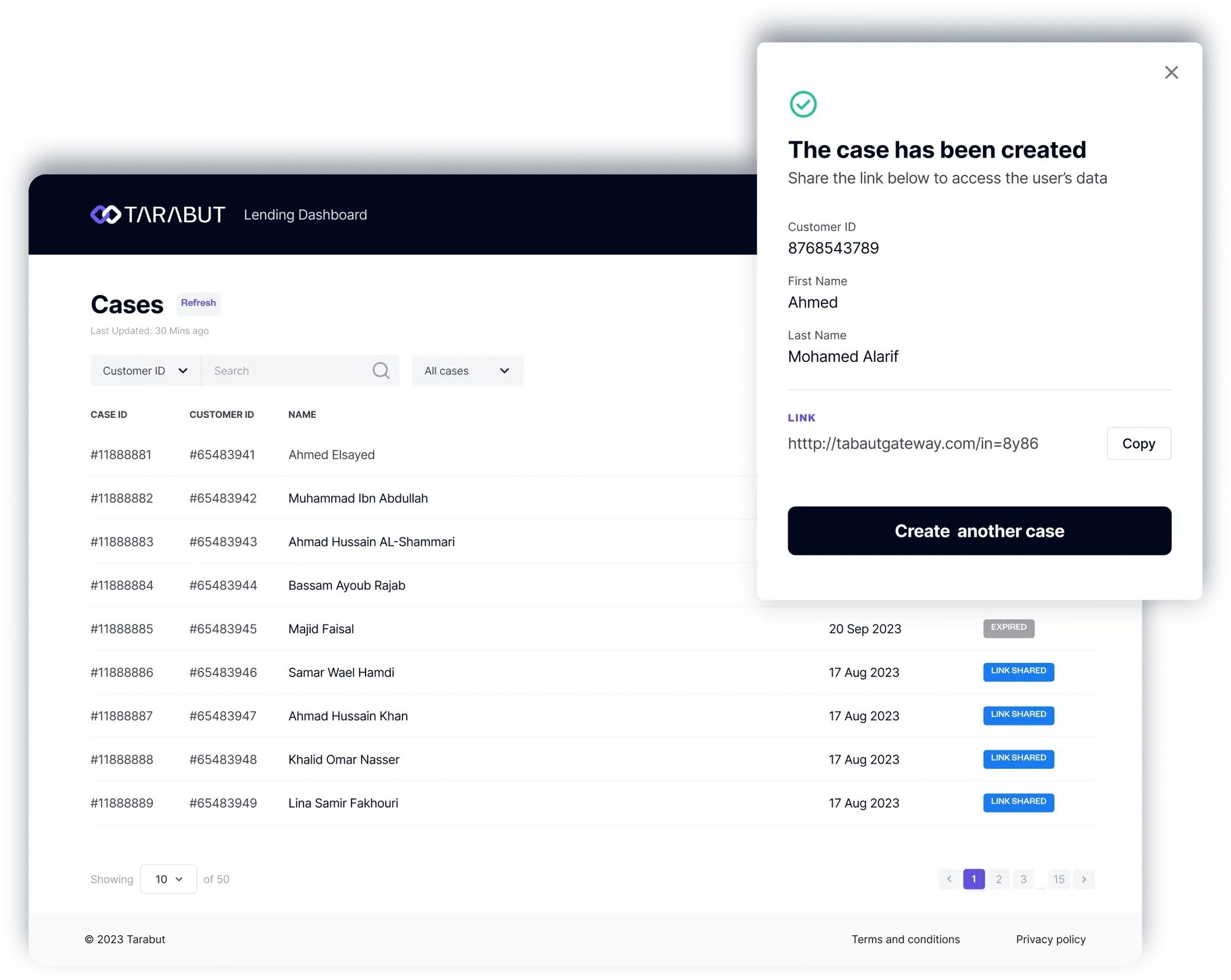

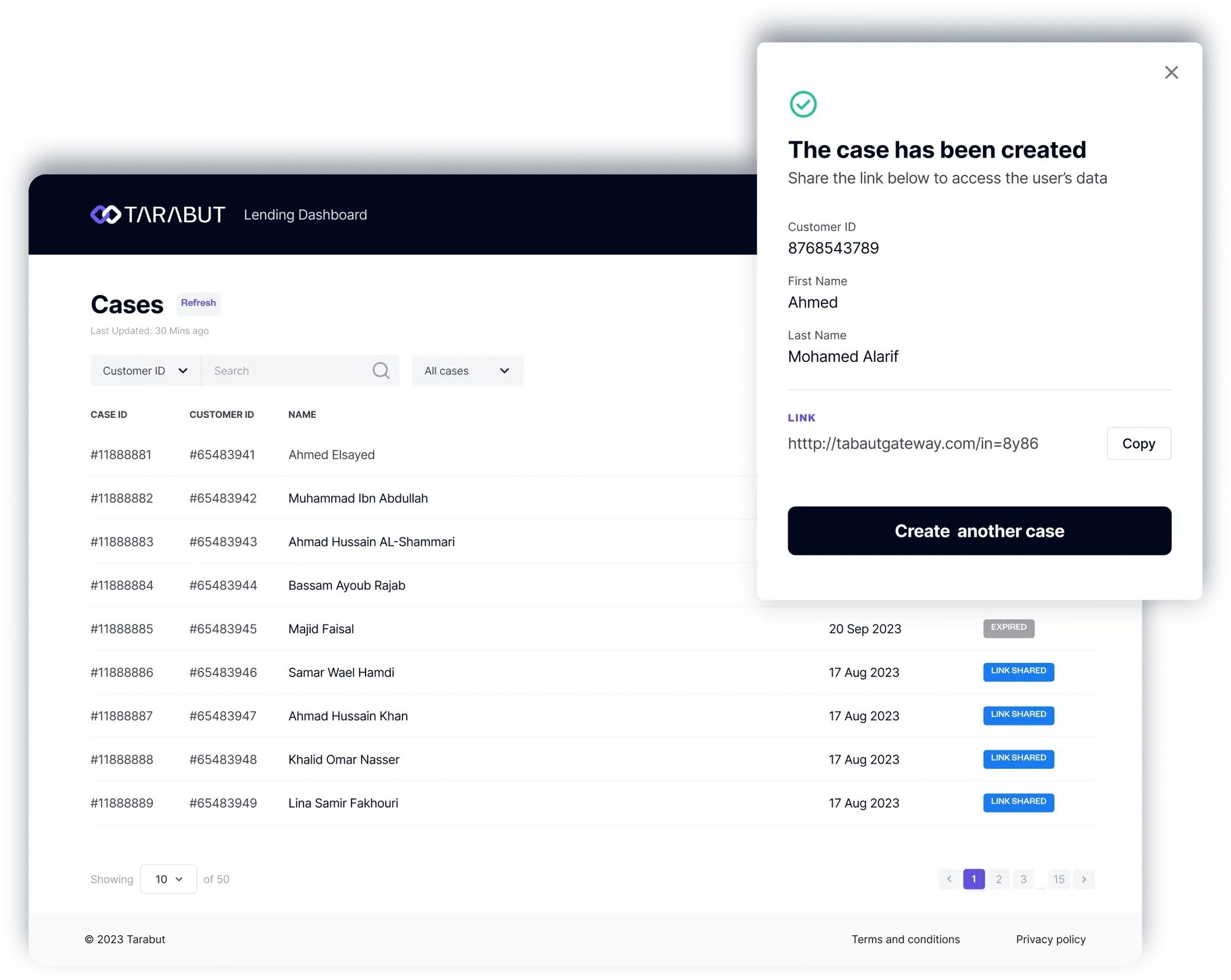

1Generate Secure LinkCreate and send a secure link to request customer financial data.

-

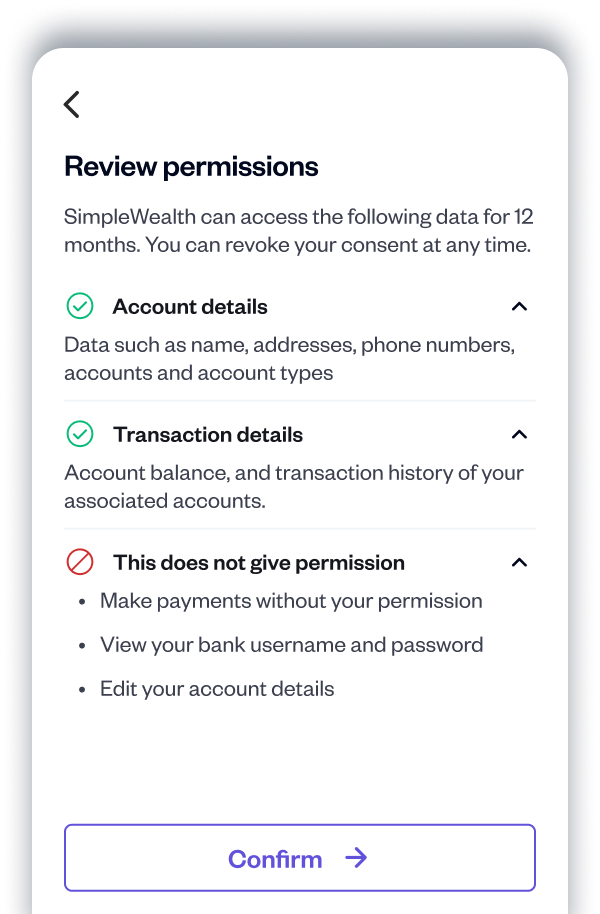

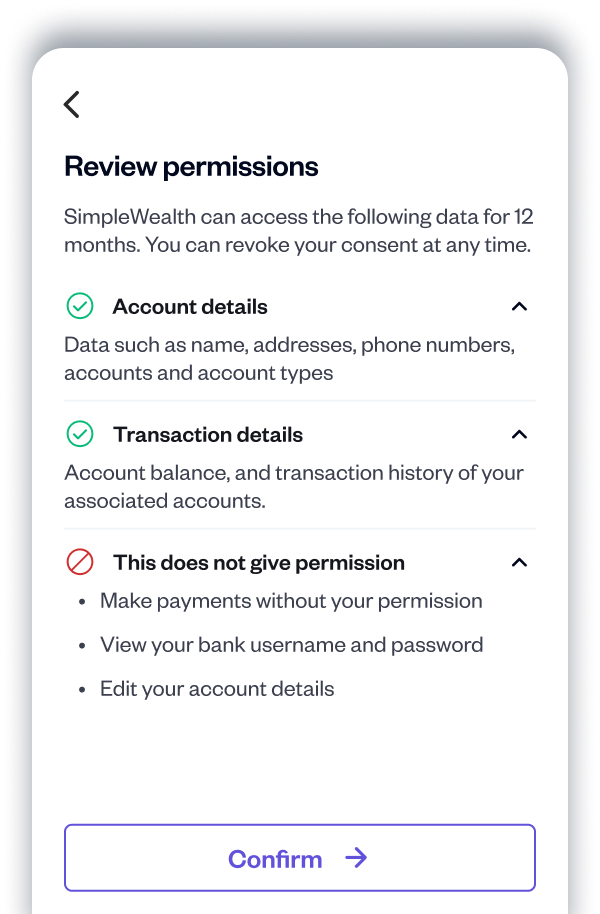

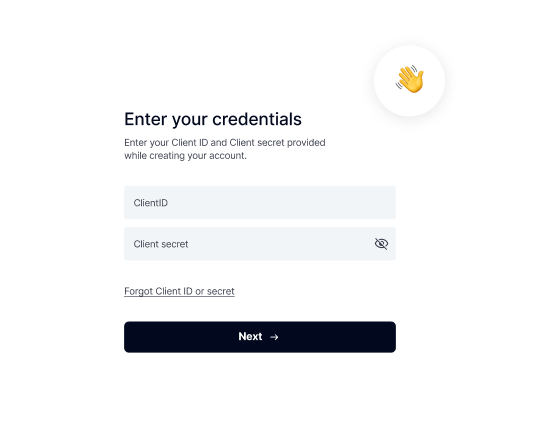

2User AuthenticationCustomer authenticates and consents to sharing their data

-

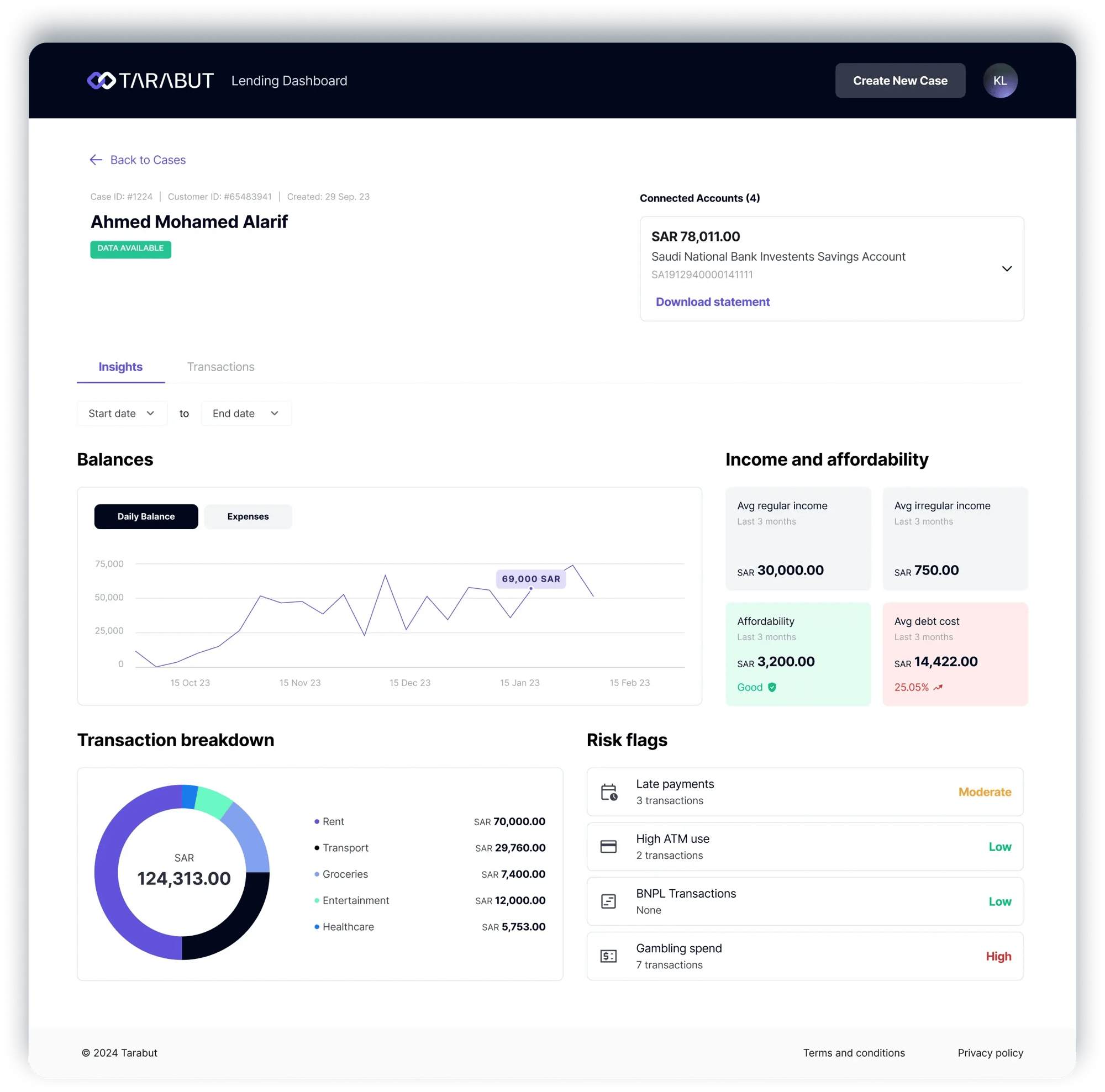

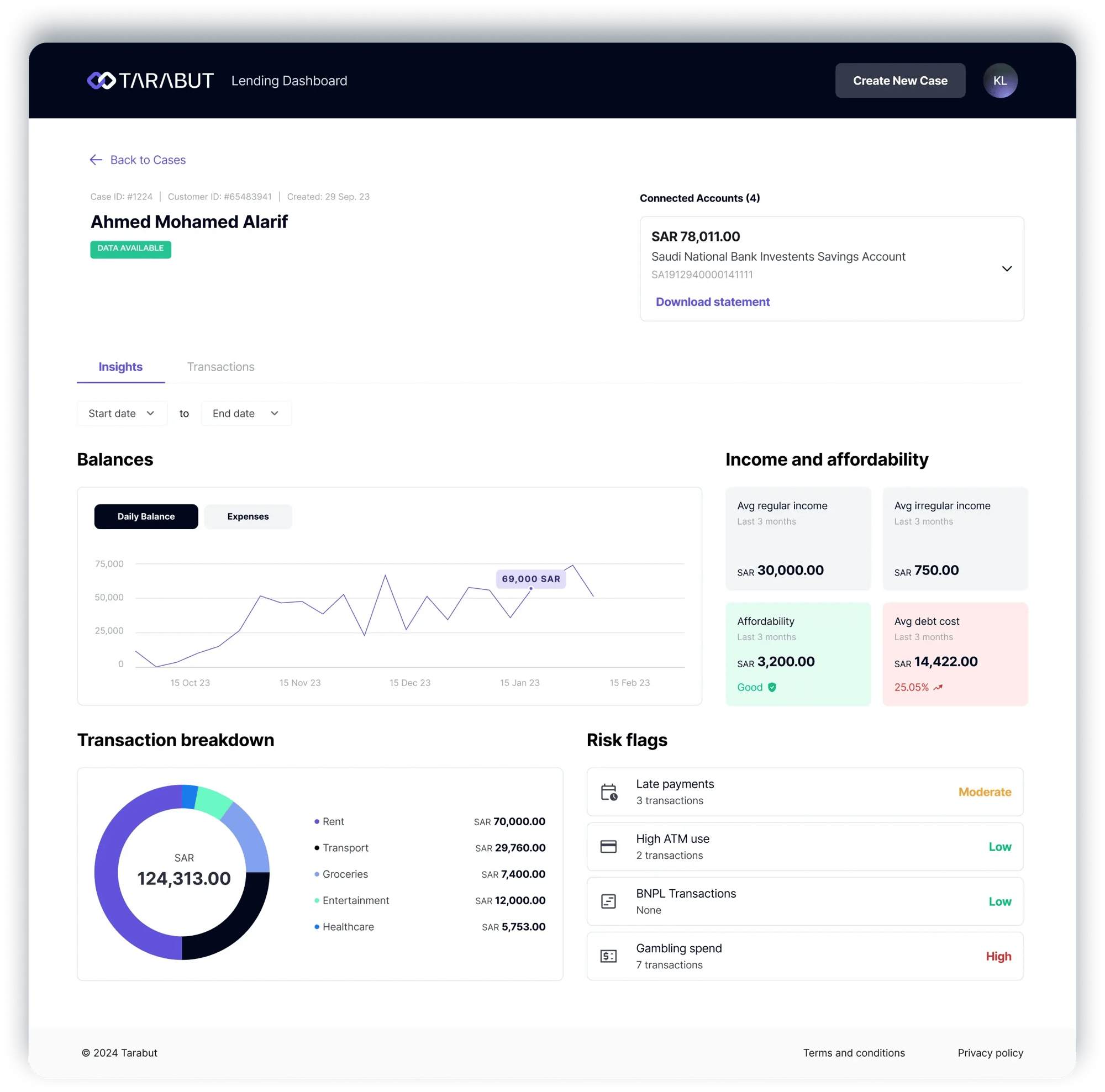

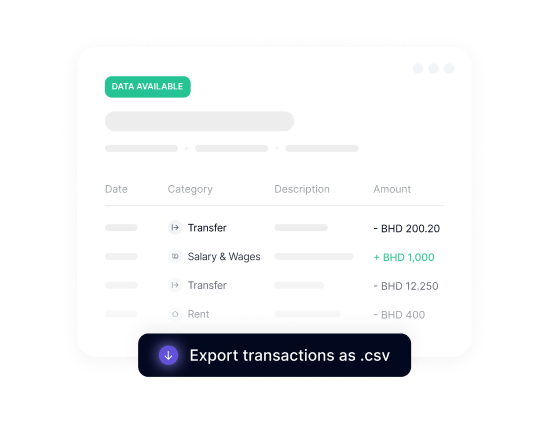

3Access Financial InsightsSee customer financial data in the dashboard, including balances and categorized transactions.

Insights at a glance

Features built with you in mind

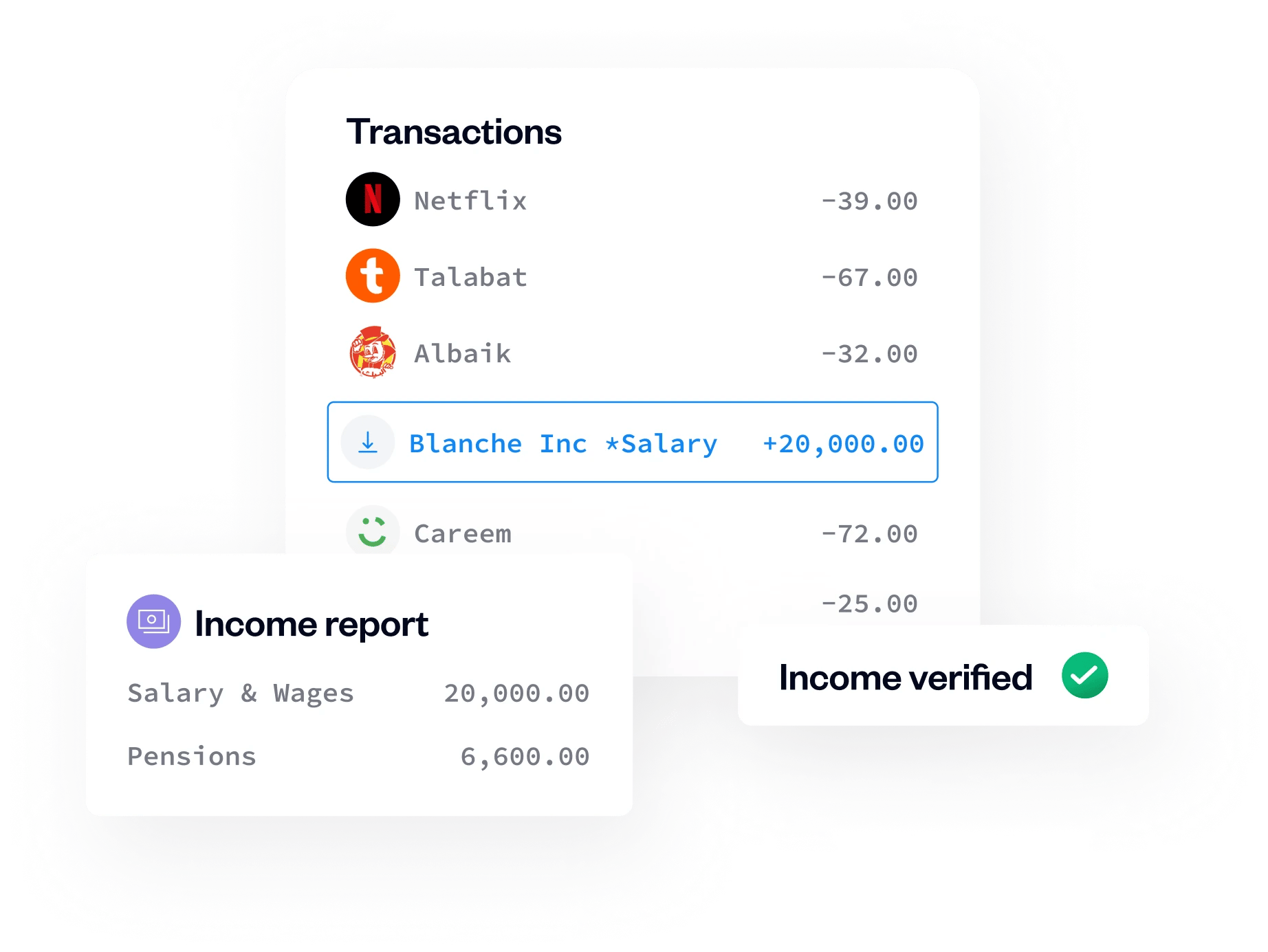

Income Insights

Use advanced pattern recognition, machine learning (ML), and keyword analysis, to accurately verify an applicant's income. Categorise credit transactions into two primary groups, salary & wages and pensions, ensuring a comprehensive and precise income assessment.

Balance Trends

Track your customer's financial health with up to 12 months of daily balance history displayed in a comprehensive graph format. This feature allows you to quickly identify trends and spot anomalies, offering valuable insights into your customer's financial stability.

No-Code Integration

Get started quickly without the need for complex integration. This feature ensures that you can use the dashboard without requiring IT support, allowing you to focus on making lending decisions rather than dealing with technical hurdles.

Download Transactions

Export or download transaction data for further analysis or record-keeping. This feature offers flexibility and ease of use, allowing you to work with the data in the way that suits your needs best.