TRUSTED BY

CHALLENGE

Costly data assessments

Traditional approval processes often entail costly data checks on every applicant, regardless of their likelihood of approval. This approach leads to wasted resources, as lenders end up paying for checks on applicants who are ultimately declined for credit. These unnecessary expenses not only drain financial resources but also contribute to prolonged approval times and operational inefficiencies, hindering lenders' ability to make informed decisions quickly and effectively.

SOLUTION

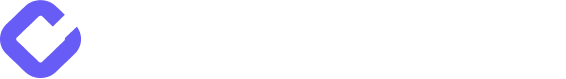

Find declines early and reduce costs

Spotting potential declines early is key to saving money on unnecessary data checks in the lending process, and that’s where Pre-Check comes in. By leveraging real-time Open Banking data, Pre-Check empowers lenders to identify applicants who are likely to be declined early in the application process, helping you make informed decisions quickly, reduce costs, and enhance overall operational efficiency.

Reduce cost per acquisition by up to 30%

Save money per application, by identifying potential declines early. Leverage accurate financial insights to help you make more informed lending decisions.

Financial insights you can trust

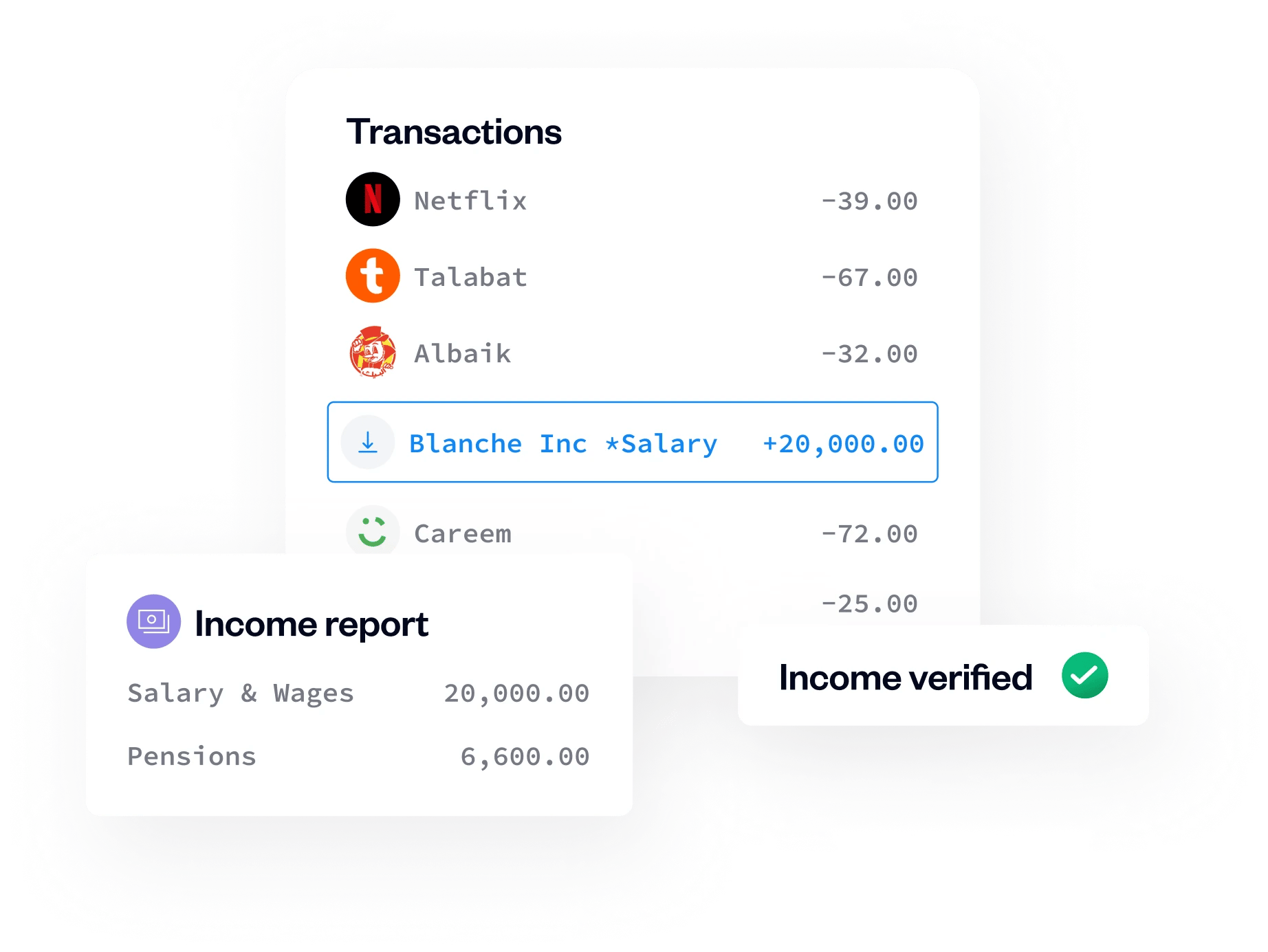

Income Insights

Use advanced pattern recognition, machine learning (ML), and keyword analysis, to accurately verify an applicant's income. Categorise credit transactions into two primary groups, salary & wages and pensions, ensuring a comprehensive and precise income assessment.

Flexible Integration

Seamlessly connect via our robust API for automated decision-making capabilities, or opt for our intuitive no-code solution, ideal for manual assessments. Choose the method that best aligns with your requirements and streamline your processes effortlessly.

LICENCED BY

LICENCED BY