Streamline Lending Applications

Say goodbye to manual data entry and paperwork, saving valuable time and resources. Experience an accelerated application process, faster loan approvals, and a seamless borrower experience that sets you apart from the competition.

Expand Market Reach

Unlock new lending opportunities by extending your reach beyond traditional customers. Target and assess thin file customers not visible on traditional credit assessment data. Expand your customer base and tap into previously untapped markets, driving business growth and diversifying your lending portfolio.

Improve Decision-Making

Enhance risk assessment, accurately price loans, and safeguard your lending portfolio. Leverage up-to-date, granular transaction information and gain comprehensive insights into a user's income, expenses, and financial behavior.

The customer lending experience and journey must be reimagined as customers expect more from their financial service providers. Working with the team at Tarabut, FLOOSS has been able to implement a customer-first solution that improves lending processing times to a few seconds and more seamlessly than any other lenders, anytime and anywhere.

Fawaz Ghazal

Chief Executive Officer

Use cases

- Lending

- Fraud Prevention

- Personal Finance

- Payments

Better data, better decisions

Access comprehensive financial data, make informed lending decisions, and streamline processes for faster approvals. Stay ahead of the competition and unlock a world of lending possibilities.

Safeguard against fraud

Leveraging secure APIs and real-time access to customer financial data to enhance identity verification, detect suspicious activities, and prevent fraudulent transactions, safeguarding business and customer assets to help maintain trust and loyalty.

Personal finance

Provide a complete solution for personal finance that aggregates accounts, categorizes expenses intelligently, and enriches transactions. Empower users to make informed financial decisions and enhance their experience with comprehensive PFM capabilities.

Payments

Enhance your payment capabilities with faster, more secure, and cost-effective transactions. Streamline your processes and offer seamless payment experiences.

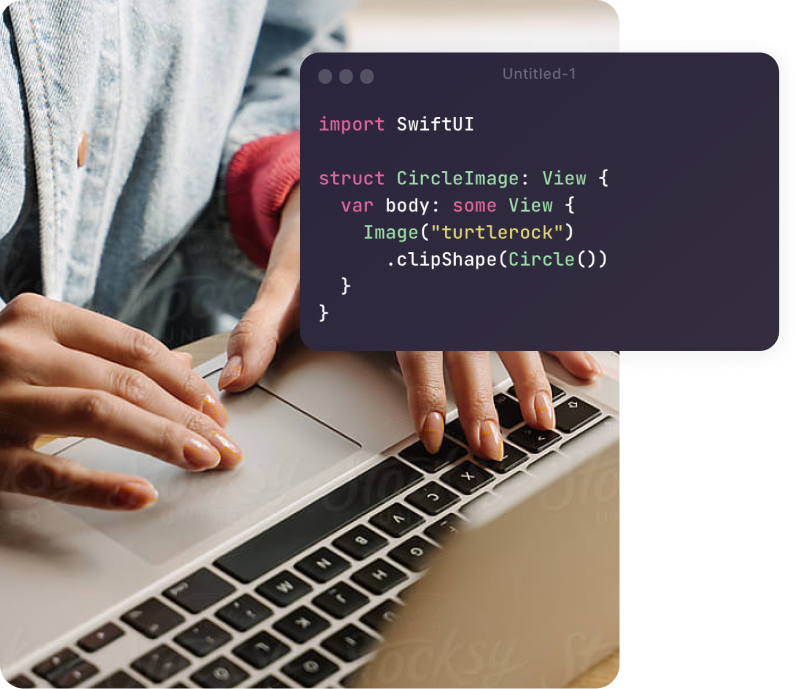

Build with us

This one’s for the developers!

Extensive API Coverage

Gain access to an extensive collection of powerful APIs covering various financial services and functionalities.

Simplified Integration

Easily integrate our APIs into your fintech solutions using developer-friendly tools and documentation, reducing development time and effort.

Dedicated Developer Support

Prompt and reliable assistance from our experienced support team to help overcome any challenges and ensure a smooth development experience.

Secure Sandbox Environment

Test and validate your applications in a secure sandbox environment, ensuring optimal performance and reliability before launching.