How it works

Effortless account connections with our simple user flows, ensuring a seamless and hassle-free experience.

-

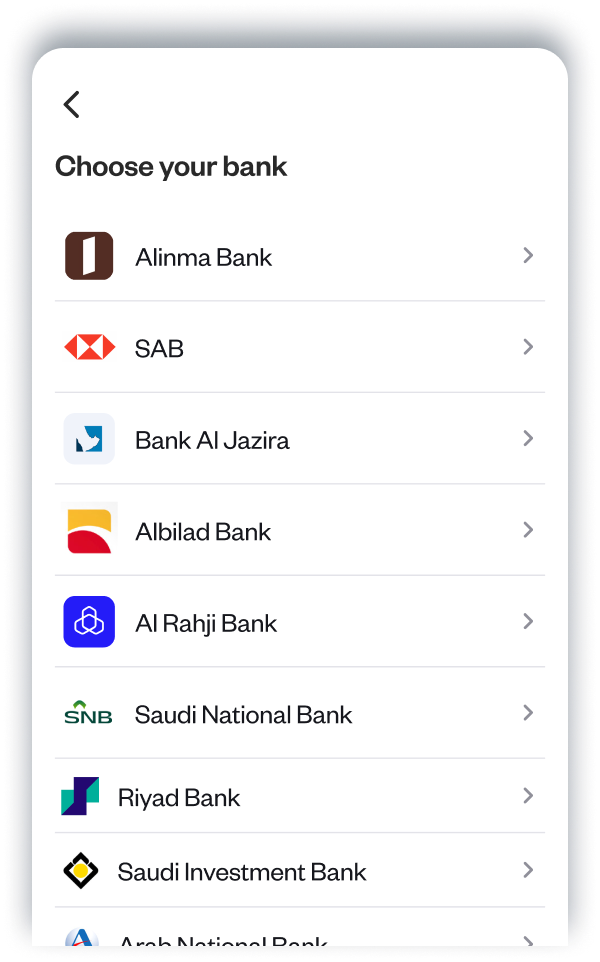

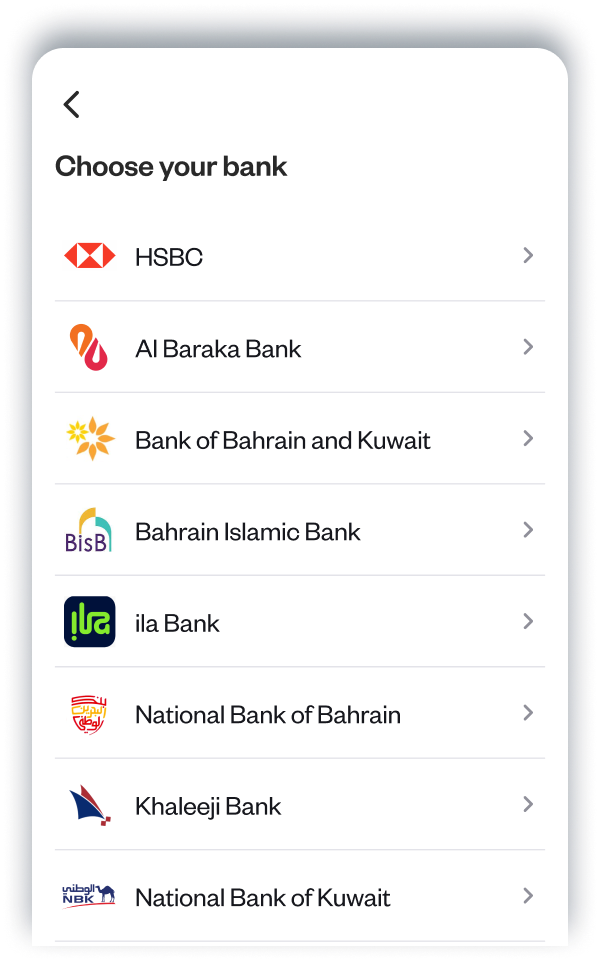

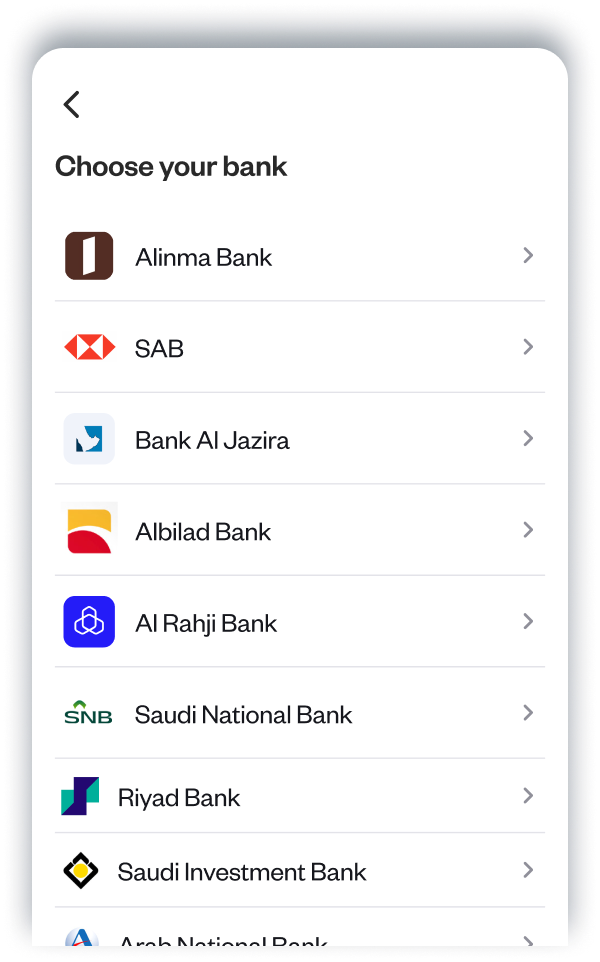

1Select BankCustomers choose their salaried account provider from our list of banks.

-

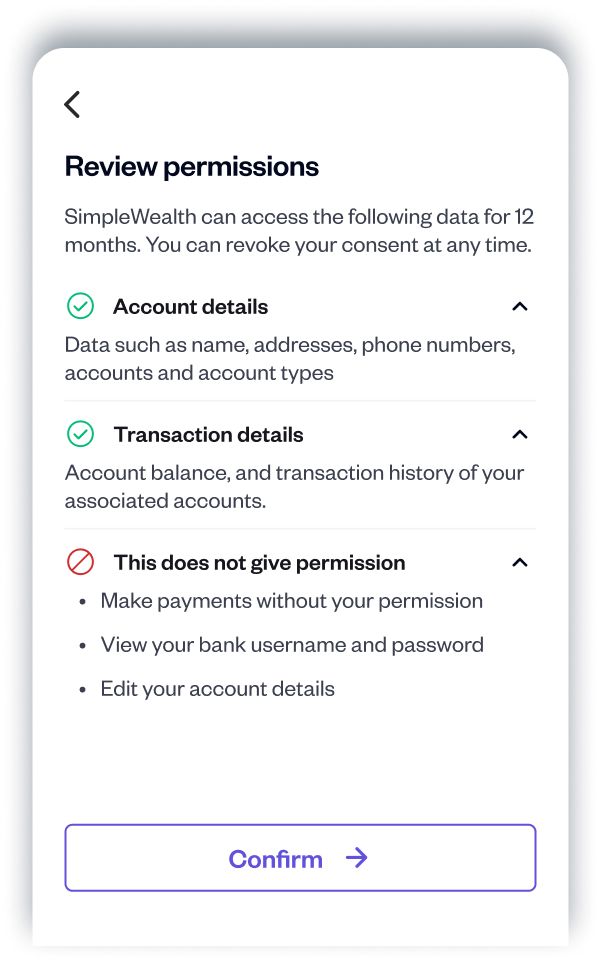

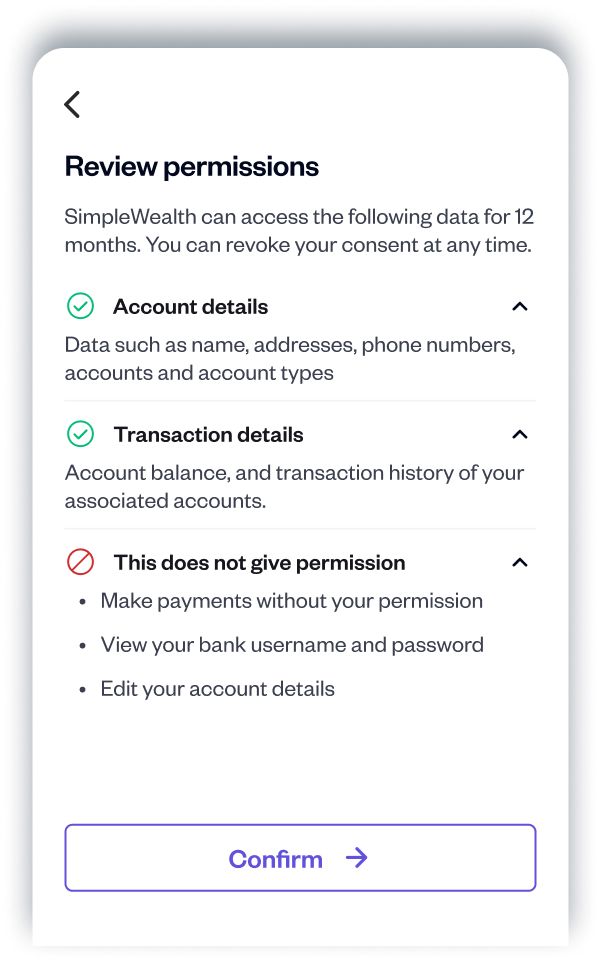

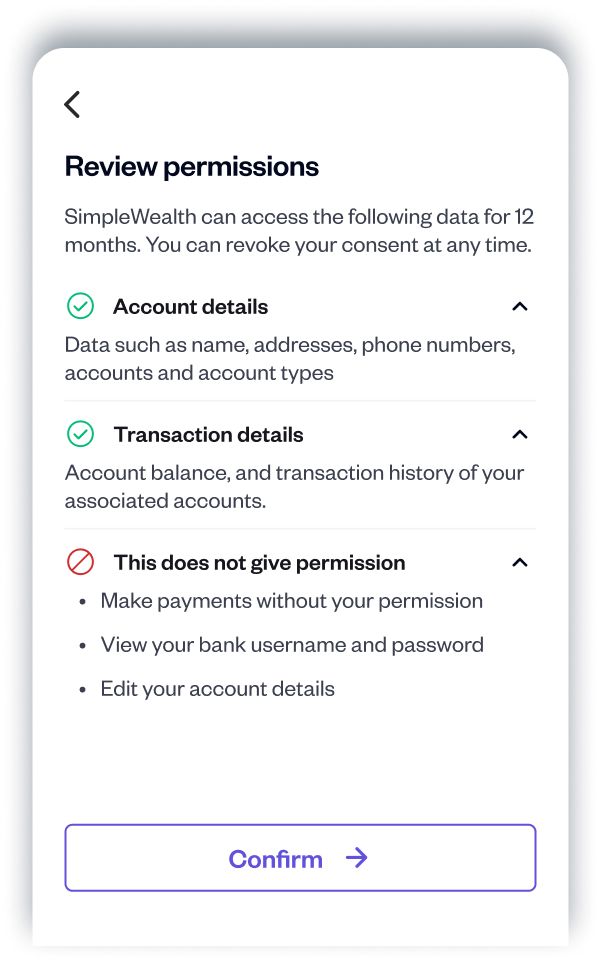

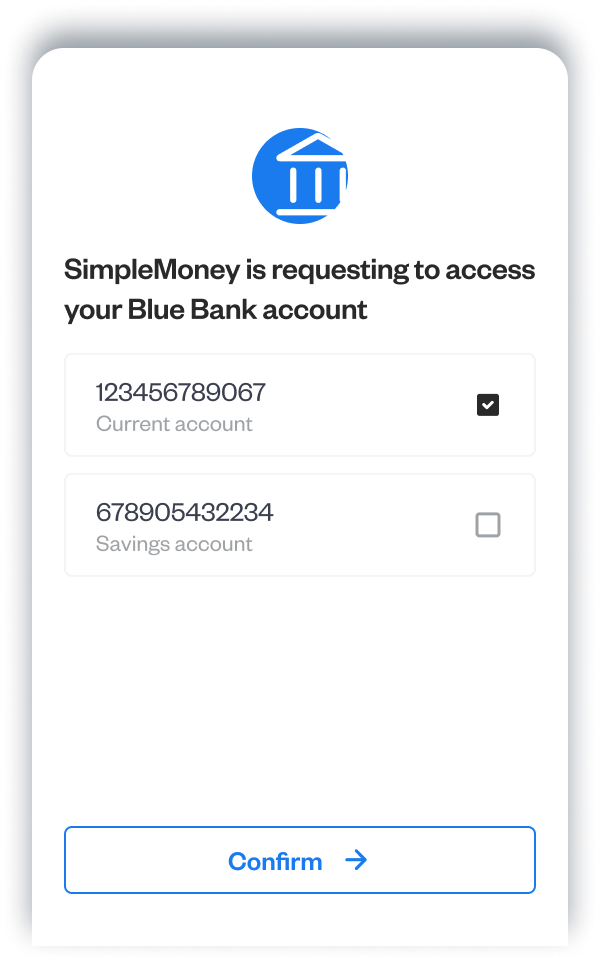

2Review permissionsCustomers review and grant consent for data sharing.

-

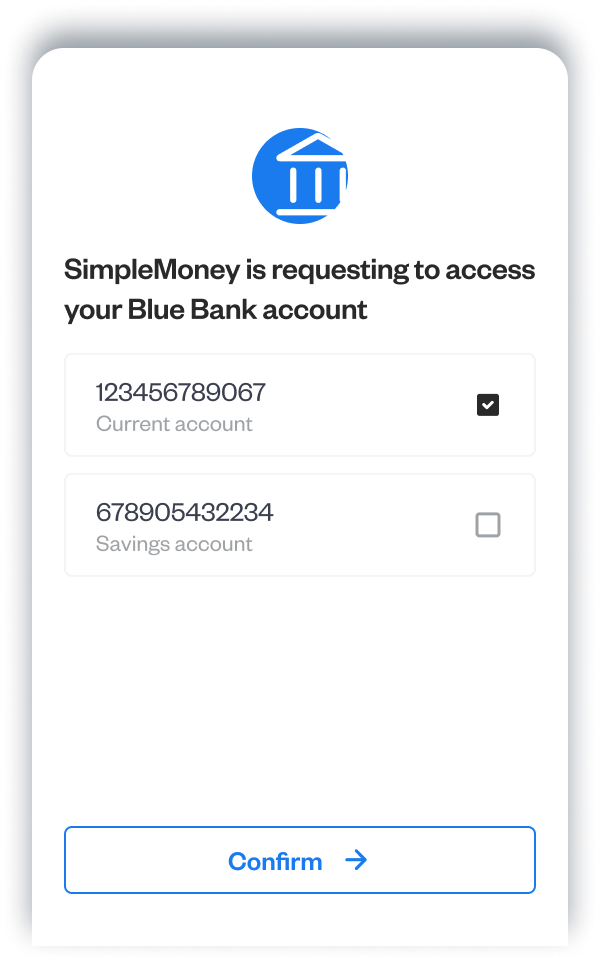

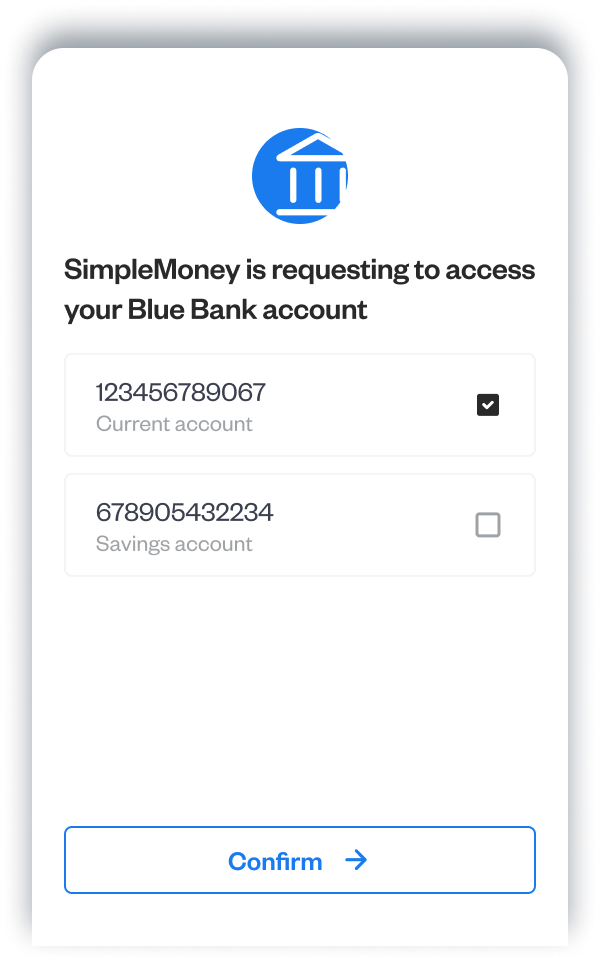

3AuthenticateCustomers verify their credentials to authorise data access.

-

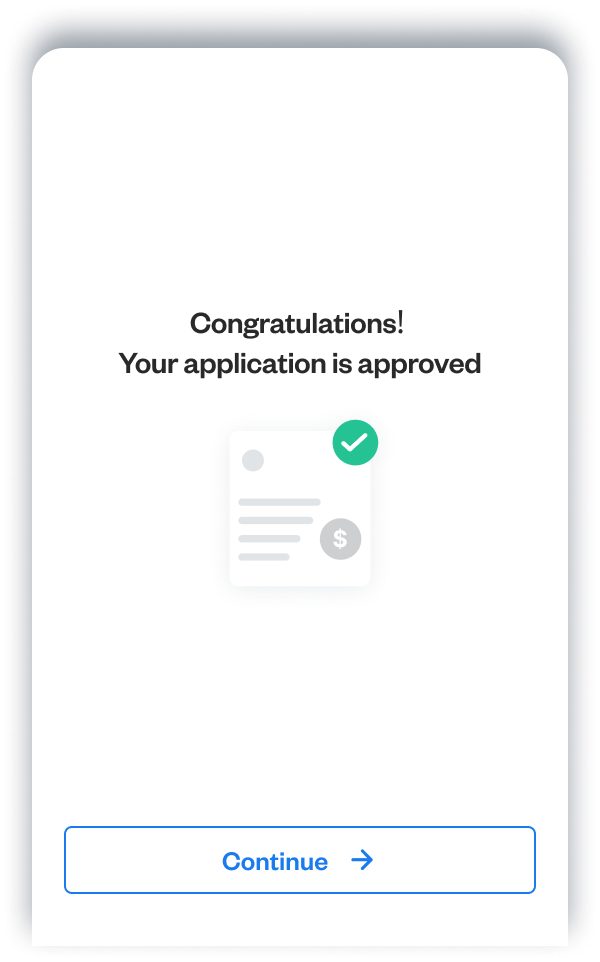

4ConnectedSalary transactions are fetched and identified in real-time.

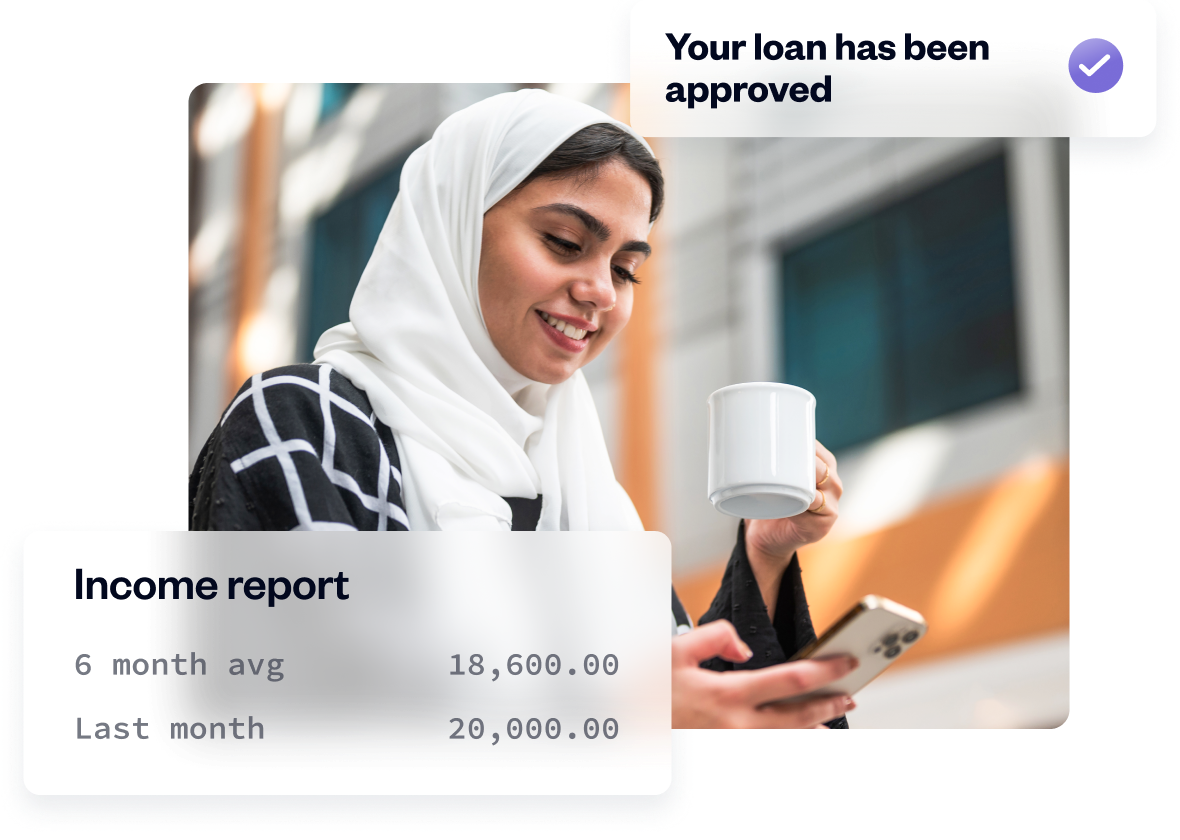

How industry leaders use Income Verification

LENDING

Better data, better decisions

Leverage real-time transaction data and insights to drive revenue by expanding customer segments, reducing declines, and streamlining origination processes. Provide tailored offerings that better meet users' financial situations, enabling informed lending choices that lead to success for you and your customers.

Contact Us

The customer lending experience and journey must be reimagined as customers expect more from their financial service providers. Working with the team at Tarabut, FLOOSS has been able to implement a customer-first solution that improves lending processing times to a few seconds and more seamlessly than any other lenders, anytime and anywhere.

%20(1)-1.png?width=81&height=80&name=lan_FILL0_wght300_GRAD0_opsz48%202%20(1)%20(1)-1.png)