Banking is a profession as old as time. Some say it dates back all the way to 1,800 BC Babylon! We’ve obviously come a long way since then, but over time the industry has picked up a reputation for being something of a one-way street where only a few rule the road.

But thanks to newer and more advanced technologies, banks and fintechs are coming together to hail a new chapter – a chapter that sets up the sector stronger for the future. Traditional brick-and-mortar banking is becoming a thing of the past and digital banking is on the rise. Fintechs around the world are tapping into the power of digital technologies and they’re helping make banking leaner, smarter, and more customer-centric.

And best of all, legacy banks are joining the revolution!

Right now, banking is the poster child of innovation. With artificial intelligence, blockchain, and open banking on the rise, traditionally operating banks are getting what is called a “modern makeover.” They’re on their way to saying goodbye to cost-intensive physical branch networks to embrace digital models.

And much of this shift is being led by changing customer expectations.

No one wants to waste time lining up and waiting. People want speed. They want convenience and customisation. And they want it at every touchpoint in their banking interactions. Because think about it – with so much technology at our fingertips no one needs to physically be in a place to make a simple transaction.

And because the landscape is changing (and it’s changing fast) financial services providers who have simplified their operations and digitised their products are leading in terms of service innovation, customer experience, and, ultimately, bottom-line growth.

And out of all the players in the markets, it’s neobanks that are unlocking the full potential of technology in banking to show the industry what’s possible.

Here’s a hint – they’ve embraced a new way of banking that streamlines data sharing, drives innovation, and empowers the customer.

But we’ll get to that in a bit… first, let’s tackle what exactly is a neobank?

Neobanks have one defining feature that separates them from their traditional counterparts. They don’t have a physical presence. As ‘digital-only’ banks, neobanks offer the full set of banking products and services but they just do it through online channels.

The real clincher here is that because of this leaner operating model neobanks are disrupting the global financial services industry. All their banking functions and services can be provided through a simple, yet highly functional, mobile app.

Neobanks are lean, efficient, and profitable at scale. And that’s why they’ve been on the rise globally.

Reports show that around 400 licensed neobanks have been created in the last decade alone. Their radical approach to banking has made them popular with both customers and investors, and their valuation has skyrocketed in recent years. The world’s biggest neobanks, including Revolut, Monzo, and N26, are essential to the future of banking.

But what’s most relevant for us is that the neobanking trend is now also picking up pace in the Middle East and other emerging markets as well.

That’s the million-dollar question. If you look at the market, you can see that neobanking is becoming increasingly popular in the Middle East off the back of shifting consumer preferences and supportive regulations. Research estimates that about 60% of users in the UAE and Saudi Arabia prefer banking via mobile applications. And neobanks are riding this wave of digitalisation in the region. There are currently over 20 neobanks innovating in the space, serving over 15 million customers.

But here’s what’s interesting about this market – while much of the hype around disruption in banking revolves around fintech startups, it’s actually incumbent banks that are driving the neobanking revolution in the region. Many traditional players are seizing the opportunity offered by technologies, such as open banking and AI, to launch their own standalone neobanks.

To get an idea of what we’re talking about, look no further than Liv by Emirates NBD (UAE), ila Bank by ABC Bank (Bahrain), and Mashreq Neo by Mashreq (UAE). There are also other independent neobanks operating in the same space.

Let’s just say it’s an exciting time to be a neobank in the Middle East. But before getting caught up in the hype, consider what it takes to scale a neobank to success.

TL;DR: Yes…but there’s a few catches.

Operating with lower cost structures allows neobanks to streamline their entry in banking. But their initial competitive edge does not guarantee a path to profitability. To scale and to scale fast, neobanks must first overcome a number of challenges.

Take a look at four challenges facing neobanks today.

In short, neobanks have to win customer trust by differentiating beyond the ordinary. They need to lower acquisition costs, gain access to financial data held by banks, and collaborate with incumbent banks in many places to scale to profitability.

The good news for neobanks is that there’s just one very practical solution to all these issues. And that’s open banking!

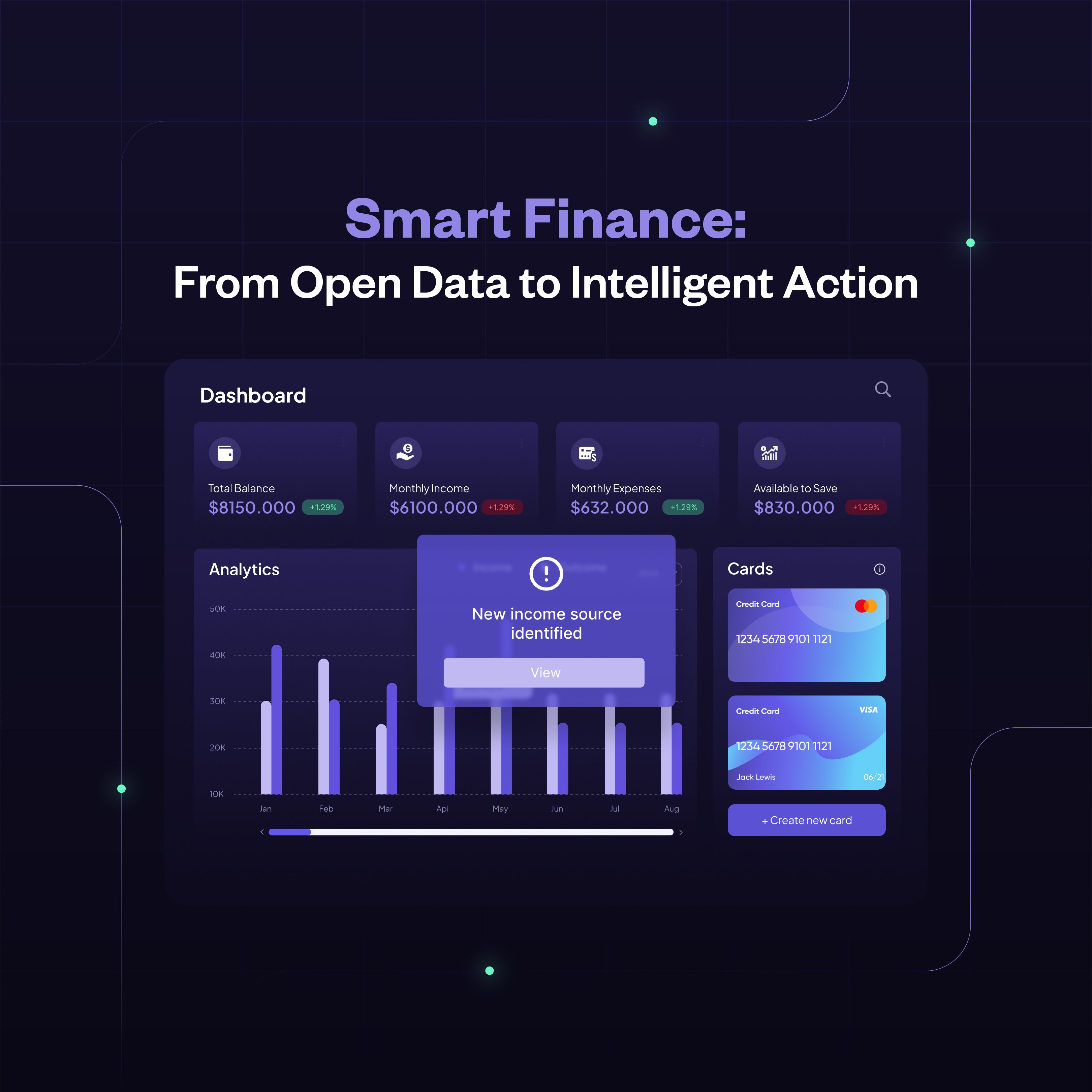

Open banking makes data sharing between banks and third-party providers like neobanks a piece of cake. It does that through secure application programming interfaces (APIs). APIs are a type of digital bridge that neobanks can leverage to gain full access to the treasure trove of financial data that traditional banks are sitting on. With this data, neobanks can compete with big banks and overcome the hurdles on their path to growth.

But there’s even more. The best use case of open banking for neobanks is account aggregation. With open banking APIs, neobanks can provide users with a holistic snapshot of their financial accounts and activity across banks and fintech providers. This allows them to:

By facilitating seamless data sharing, open banking APIs enable cost-effective collaboration between neobanks and their traditional counterparts.

In addition, open banking APIs are secure and require the consent of the customer before transferring banking data to fintechs. Couple that with innovative products and services delivered efficiently, and neobanks can overcome trust and acquisition challenges, capture more market share, and scale faster!

Open banking is the perfect growth catalyst for neobanks. But they can’t develop their own APIs from scratch without heavy capital investment and the required tech expertise. It’s best to partner with a licensed open banking platform with a big enough footprint in the industry to help them scale and succeed.

Take our TG Connect solution as an example. Neobanks can integrate TG Connect with their internal tech infrastructures. Once connected, they get a direct line of communication with key banks in the region. All that’s needed then is the customer’s permission to access their data. And the data secured through TG Connect allows our partners to:

It’s an opportunity to better understand how customers behave and what they require from their financial providers. And in this digital age, customer obsession is the fastest way to grow and scale, isn’t it? Sign up to our Developer Portal and start building customer-obsessed solutions!

Sign up here to receive news and updates.