It's been an exciting month at Tarabut, jam-packed with new partnerships, feature updates, and a wave of talented new team members. We also clinched ...

Highlights

We were honoured to be awarded 'Fintech of the Year' by the MENA Fintech Association and ‘SME of the Year’ by the Gulf Business Awards!

This recognition underscores our commitment and dedication to propelling the financial ecosystem in the region further. This would not have been possible without the invaluable contributions of our partners and exceptional team, who have been integral to our journey.

As we celebrate these milestones, we're eagerly anticipating the future. We look forward to deepening our collaborations with existing partners and forging new relationships that will undoubtedly contribute to MENA's continued success and growth.

We are delighted to introduce the newest members of our growing team in KSA!

Check out our latest opportunities here.

Arib is now live with our Account Verification API!

We are powering Arib with one of the first Account Verification use cases in the Kingdom! Enabling their users to seamlessly connect and validate account ownership to ensure accurate fund disbursements, eliminating manual verification processes. For a simple, safer, and more efficient experience.

Product Updates

We're excited to announce a significant enhancement to our Account Verification product.

Eliminate the hassle of manually matching IBAN data. With our latest feature, we can effortlessly match a user's IBAN against all available IBANs from their consented accounts, ensuring a safer and more seamless experience.

Our bank coverage just got better!

Gulf International Bank (GIB) and The Saudi Investment Bank (SAIB) are now part of our connected banks in the region, offering broader access to accounts in the Kingdom. This paves the way for financial service providers to create more personalised products and experiences, with a wider market of consumers who can now adopt Open Banking.

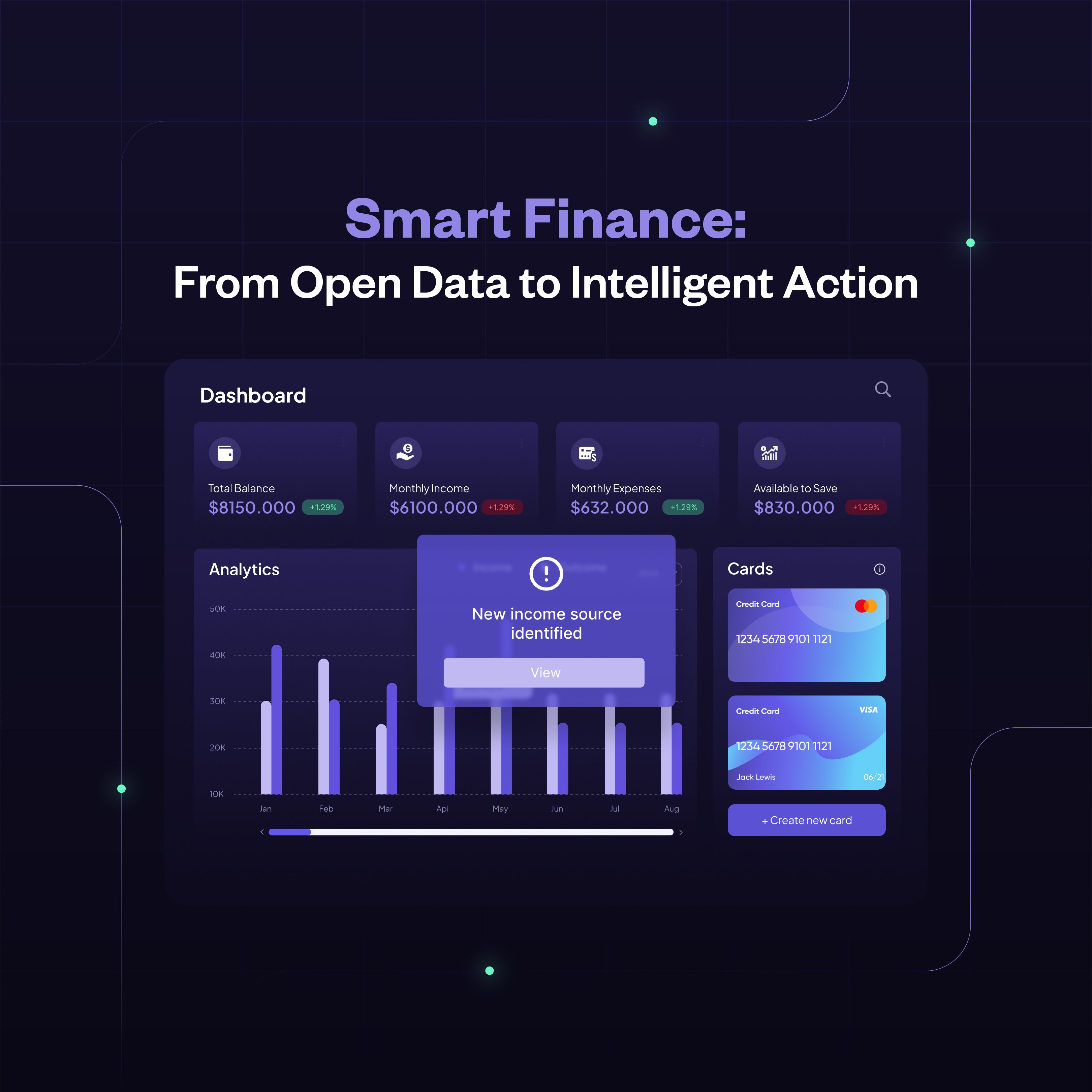

We’ve built some new end-points to help you gain more insights into your customers' transaction data. Here’s what’s new;

Income Insights: Retrieve income insights for specified user accounts, including regular and irregular income streams and an overview of credit transactions.

Balance Insights: A comprehensive view of the balance insights for a specific user account, including minimum, maximum, and average balances over a defined period

Balance History: Retrieve historical balance data of a specific user account over a defined period.

Spending Insights: Categorises transactions to understand spending habits better, classifying each transaction based on its merchant and associated category.

Risk Flags: Insights into potential financial risks associated with an account to help identify behaviours or patterns of risk.

New Partnerships

Earlier this month, we announced our exciting new partnership with Moneyloop, a platform empowering individuals in KSA through participatory and collective savings services.

Together, we’re simplifying payouts for Moneyloop users, allowing them to verify their IBANs in minutes! Eliminating the need for manual account verification processes for a simple, safer and more efficient payout experience.

We're spotlighting Alinma Bank’s achievement as the first bank in the Kingdom to go live in production with the KSA Open Banking Framework Certification for AIS (Retail and Corporate).

This achievement exemplifies Alinma's commitment to innovation and progress, shaping the future of financial services in Saudi Arabia. We are proud to have powered this milestone and eagerly anticipate its positive impact on Saudi Arabia's financial sector.

Get in touch to learn more about our open banking Compliance services.

We are excited to announce our partnership with Mthmr, a leading Personal Finance Management app in KSA!

Through this partnership, Mthmr’s users can connect their bank accounts and aggregate all their financial data in one place for a holistic view of their balances and transactions.

Want to know more?

Get in touch with the team to learn more about how we can help.

Sign up here to receive news and updates.